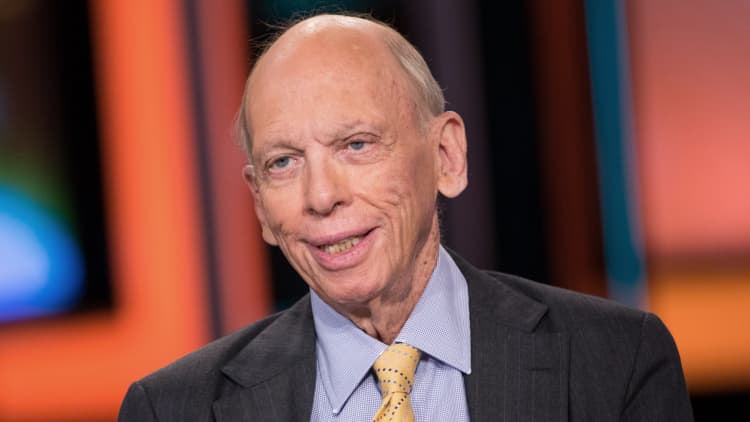

The U.S. trade fight with China is a "serious" issue, but the ongoing conflict won't cause a recession or a steeper downturn in stocks, Wall Street veteran Byron Wien told CNBC on Thursday.

Wien, vice chairman of private wealth solutions at Blackstone, said the 's drop of more than 5% this month is part of a "normal correction" in a stock market that is "still in reasonably good shape." He said he doesn't expect a bear market, which is typically defined as a drop of 20% or more from a market's recent peak.

"The Chinese conflict on the trade issues is serious, and I think it's going to be prolonged," Wien said in a "Squawk Alley" interview. "But I don't think it's going to create a recession or a bear market."

As of Wednesday's close, U.S. stocks are on pace for their worst month since December 2018 in part on concerns by investors that the U.S.-China trade war could cause a slowdown in the global economy. The S&P 500 closed below 2,800 on Wednesday — a key level watched by traders — for the first time since late March.

The world's two largest economies increased tariffs on one another this month, with the U.S. making the first move by increasing duties on $200 billion worth of Chinese products from 10% to 25%. China announced plans to raise tariff rates on $60 billion in U.S. goods. The tactics amplified a trade fight that has rattled financial markets and threatened to drag on the global economy.

Earlier this year, Wien predicted a major comeback to new highs for the stock market in 2019.

In a preview of his 34th annual list of year-ahead economic, financial market and political surprises, Wien said he sees the S&P 500 gaining 15% in 2019. So far, the index has risen 11% year to date.

Addressing his predictions Thursday, Wien said the trade war as well as Britain's withdrawal negotiations with the European Union are "negative" and will likely prevent stocks from making "any considerable progress" this year.

In a finance career spanning about 50 years, Wien started putting out his annual surprise list in 1986 when he was chief U.S. investment strategist at Morgan Stanley. He joined Blackstone in 2009.