Storm clouds have been brewing over Salesforce.com.

As the cloud computing giant prepared to issue its fiscal first-quarter earnings report after Tuesday's closing bell, options traders were tapering their enthusiasm for the results, Dan Nathan, co-founder and editor of RiskReversal.com, said Monday.

Cloud stocks have declined meaningfully in the last month, forcing traders to roll down their bullish bets to reflect a slightly more conservative outlook, Nathan said on CNBC's "Options Action." So, while call volume — bullish betting — was three times that of put volume, it wasn't all good news.

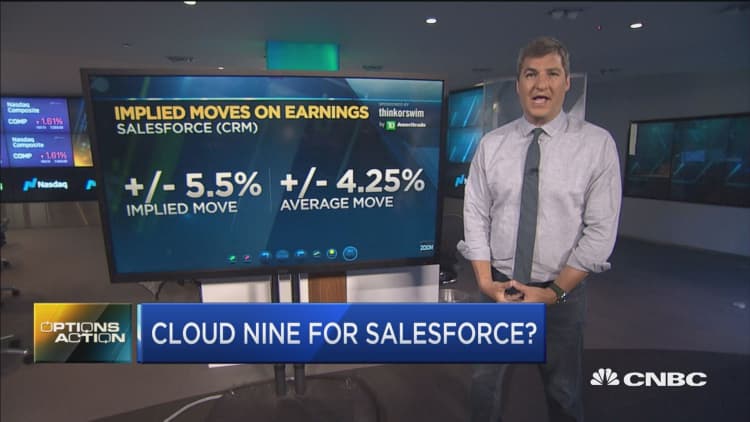

With the options market implying a bigger-than-usual 5.5% move in either direction for the stock, which typically moves 4.25% after earnings, traders were "rolling" down their strike calls to lower strike prices, a sign that they now believed Salesforce.com wouldn't run as high as they initially expected, Nathan said.

"One of the trades that caught my eye today [was] the largest trade of the day," he said. "When the stock was trading at $148.30 shortly after the opening, a trader sold to close 7,000 of the September $155 calls and bought to open 7,000 of these September $150 calls, ... just rolling it closer to the money."

Part of the reason for these slightly more conservative bets is the vulnerability of Salesforce's chart, Nathan said. Having recently broken down below key support just above the $140 level, things are looking riskier, he said.

"The stock had been trading in a very tight range for months now," underperforming the Nasdaq in the meantime, Nathan said, adding that the five-year chart shows Salesforce making a typically bearish "double top" pattern.

"Obviously, there's some pretty good room to the downside if this thing were to break," he warned. "Some of the other names that have reported lately, Workday in particular, [have] not traded that well after some of the metrics were not up to snuff, especially for a stock that trades at the valuations that these do."

Salesforce shares traded higher Tuesday, gaining nearly 3% by afternoon. The stock is up about 8% year to date.