Government regulation of the tech industry has been a big topic of conversation at this year's Allen & Co. conference in Sun Valley.

Facebook's Mark Zuckerberg and Sheryl Sandberg, Amazon's Jeff Bezos, and Apple's Tim Cook and Eddy Cue are walking the paths of Sun Valley before sending representatives to testify in an antitrust hearing on Capitol Hill next week.

Zuckerberg has asked for regulation, saying it's not appropriate for his company to be making such big decisions about the likes of what content should be banned, but he doesn't want to the company to be broken up.

The consensus among executives we spoke to: Regulation is inevitable, but doing it right is tough, and breaking up the tech giants would be challenging and perhaps misguided.

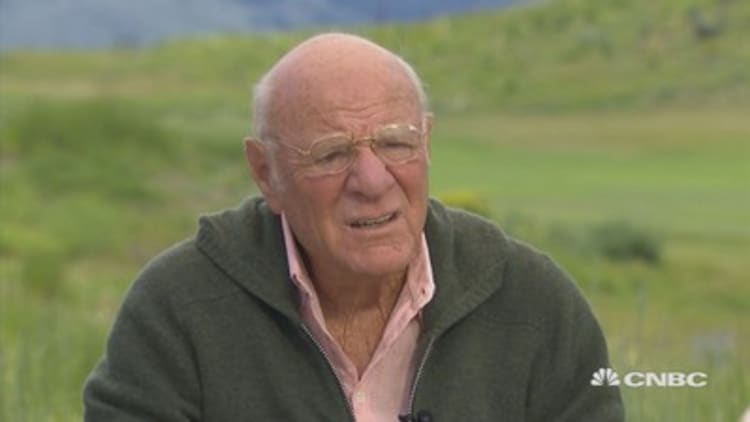

Longtime media mogul Barry Diller told CNBC, "There should be regulation that's tailored to some of the things that are outgrowths of having certain market size, where you can dictate things that may not be in, let's call it, fair playing fields, the best interest of all players."

Diller is the chairman of IAC and Expedia, which compete somewhat with Google and Facebook. But he doesn't think a breakup makes sense.

"I think regulation is mandatory. I think that it will happen. I don't think these companies should be broken up, unless it's proven that regulation doesn't work," Diller said.

Former Twitter CEO Dick Costolo said size shouldn't be the deciding factor.

"It's not just the fact that companies are big that should cause them to be regulated," said Costolo, now a partner at Index Ventures.

"The size of the company doesn't have really any impact on the kinds of things it might be doing," he said. "It's those specific things that companies are doing with data, the way they're managing it, or mismanaging it."

Costolo said he'd rather see scrutiny over the "cloak of secrecy that sometimes surrounds how data is being used," instead of a focus on companies' size.

Entrepreneur Sam Altman, former president of Silicon Valley start-up incubator Y Combinator, called for a similarly nuanced position.

"I think we do need regulation for sure. And I don't think that's actually that controversial anymore at this point. I think knowing when and how to break up our company is really hard to do," Altman said. "The companies have gotten so big and so powerful and so intertwined."

But he warned, "We're all sort of in uncharted territory. … [We need to] figure out how to regulate more quickly and more effectively than we have in the past, or we end up in a world where at some point we have to do it in a very clumsy way."

Costolo said he thinks it's key for regulators not to conflate privacy concerns and potential antitrust issues.

"Acquisitions might be fine and helpful and create jobs for the economy and be great for competition," Costolo said. "If, on the other hand, they're using control of a certain stockpile of data or leverage that they have in a certain market to go aggregate and scoop up all the competition in a certain market, that's a whole other story."

Altman said regulation should not disadvantage small companies like those Y Combinator worked to help for so many years.

He said it's important to figure out "how to do regulation in a way that protects consumers and does not unfairly advantage big companies, which most regulation does."

"It's really hard, and it's an area that is of intense interest to Y Combinator and me personally," Altman said. "I really do believe that start-ups and new companies are this incredible force for innovation. And if you make that harder, with clumsily written regulation, that's a net loss for the world."

Hans Vestberg, CEO of Verizon, which is regulated by the FCC, noted just how difficult it is to get regulation right and said it's better for companies to police themselves as much as possible. "I think that technology is moving so fast, regulation [is] hard."

Altman is looking for big-picture solutions, to have a generation of regulators that understand tech's risks and opportunities: "If you look at certain other countries in the world where civic service is something that the most ambitious, talented people want to go into, I think they get better regulation."

Follow @CNBCTech on Twitter for the latest tech industry news.