Tech giants including FANG stocks Facebook, Amazon, Netflix and Google parent company Alphabet are set to report earnings this week, and the options market is implying some big moves heading into the events.

Facebook leads the pack with an implied post-earnings move of 6% — or $37 billion in market cap — in either direction, while Amazon and Alphabet are both expected to move 4% in either direction, equating to market cap moves of $37 billion and $34 billion, respectively.

One trader sees opportunity in one of the most controversial names in the group: Facebook.

"I'm taking a look at Facebook; I think this is probably the biggest name that's going to be reporting," Optimize Advisors President Mike Khouw said Friday on "Options Action."

Of all the tech giants reporting this week, Facebook comes in as the year's best performer. Shares are up more than 50% in 2019, and the stock is finally on the brink of recouping all of its losses after falling off a cliff in the midst of last summer's Cambridge Analytica scandal.

But right now, Facebook is facing a moment of truth ahead of earnings, and options prices are reflecting that reality.

"In the case of Facebook, of course, heading into a catalyst like earnings, what you're going to see is that the nearer-dated options are going to see elevated premiums, and higher implied volatility," said Khouw.

"The other thing I will point out is that the longer-dated options aren't affected quite as much, so we can look at the relationship between the shorter-dated options and the longer-dated ones, and right now, it's basically at the high end," he said.

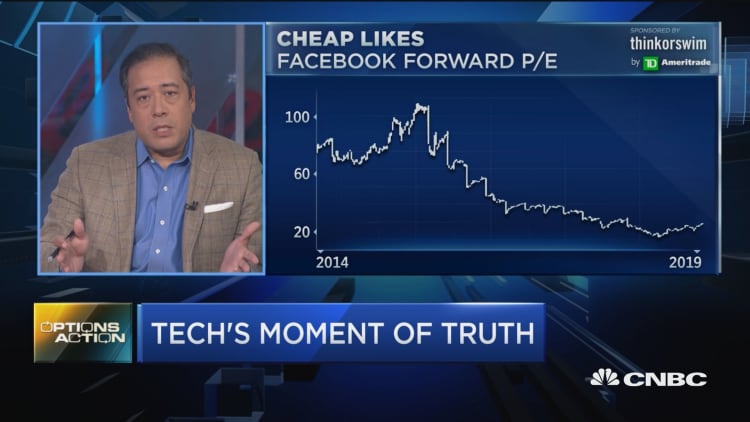

Even though options premiums are soaring, the stock itself might actually turn out to be remarkably cheap.

"Facebook, despite the fact that we've seen a very strong move in the share price over a long time, is not particularly expensive," said Khouw. "We really need to think about these things in terms of valuation, not price. On that basis, it is actually probably inexpensive. It certainly is, relative to its growth."

Given the relationship between Facebook's near-dated and long-dated options premiums, plus its cheap valuation, Khouw decided to take a look at a bullish trade: Selling the August expiration 205-strike calls to help finance the purchase of the January 2020 expiration calls at the same strike price.

"Net-net, I'm going to be laying out about $10, maybe a little bit less than that, so we're laying out less than 5% of the current stock price," he said. "The idea here is that if Facebook lingers right around where it is right now, those near-dated options are going to decay; the longer-dated ones will not decay quite so much."

"If it rallies up to that $205 strike and maybe slightly through it, we're still going to see benefits. And worst case, we're risking less than 5% [of the current stock price] if it completely fell out of bed, which is something I'm not expecting," said Khouw.

Facebook shares were trading about 1% higher on Monday.