Square looks ready to pop.

At least, options traders think so. The financial technology stock — which is up nearly 46% this year — caught a wave of bids in the options market ahead of its Thursday earnings report, with bullish bets outweighing bearish ones.

"Call volume ran really hot today. It was two times that of puts," Dan Nathan, co-founder and editor of RiskReversal.com, said Wednesday on CNBC's "Options Action." "But, interestingly, in a week that we're seeing some volatility in the broad market, a lot of the call activity was centered around short-dated calls."

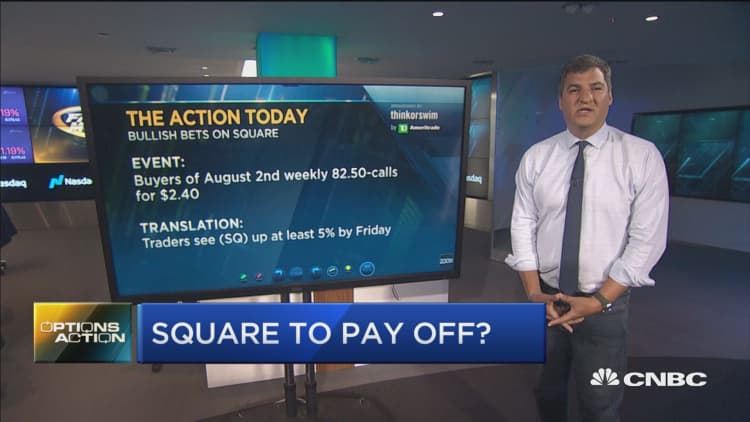

That meant traders were betting on a "near-term pop" after Square's second-quarter release, scheduled for after Thursday's closing bell, Nathan said. Square shares — which typically move 7%, on average, in either direction after earnings — were on the rise Thursday morning, climbing more than 3%.

"The most active call strike[s] were the August 2 weekly [$]82.50 calls. About 2,500 of those traded for an average of about [$]2.40," Nathan said, adding that the mystery trader was "looking for a breakeven up near [$]85."

That $85 level is the one to watch as Square prepares to report, because just under it, there's a ceiling of resistance that has been keeping a lid on Square's stock for months, Nathan said.

"This stock … looks pretty range-bound," the options expert said. "It's actually hit a bunch of technical resistance in and around $82.50, 83 bucks."

And, while Nathan was largely constructive on the stock's longer-term uptrend, he suggested traders should define their risk given Square's tendency to swing.

"The 200-day moving average looks like some pretty decent support, down about $10" from that $85 level, he said. "If you think that this company is going to post a beat-and-raise, it's still 20% from its 2018 highs. Playing with defined risk calls, isolating that range above resistance, makes some sense."

Not everybody on Wednesday's "Fast Money" desk was sold on Square.

Asked to choose between the "Jack Dorsey stocks" — Twitter and Square, both of which count him as CEO — Guy Adami, director of advisor advocacy at Private Advisor Group, knew his answer right away.

"It's easy for me: Twitter. I'm just telling you right now. I think Dan could be right on Square, but Twitter," he said.

Tim Seymour, founder and chief investment officer of Seymour Asset Management, was in agreement.

"I have to go with Twitter myself," Seymour said Wednesday. "I mean, there's no question. That's the Jack [Dorsey stock] to own, even though I own them both."