Tech stocks once again find themselves under pressure alongside the broader markets after staging a major turnaround last week, when the Nasdaq, as well as the S&P 500 technology sector, recouped nearly all of their losses after a deep sell-off.

Rather than betting on tech pulling the same rabbit out of its hat again, however, the options market is predicting that these stocks are in for a battle they can't win as the back half of the year heats up.

"Let's talk about the QQQ," said "Options Action" trader Dan Nathan on "Fast Money" Monday, "that's the Nasdaq 100 ETF, and what we know is that 40% of that ETF of 100 stocks in the Nasdaq is really weighted towards four."

As Nathan would point out, those stocks are Microsoft, Apple, Alphabet and Amazon – names among the most vulnerable amid heightened trade tensions and growing recession fears.

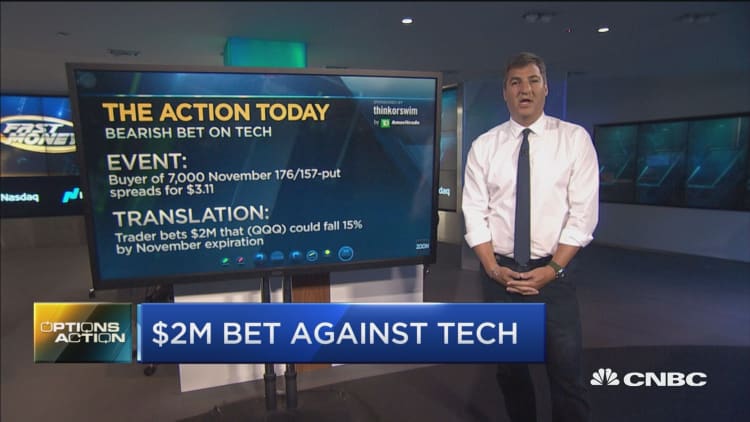

Fittingly, Monday's trading activity in the Nasdaq 100 ETF featured twice as much put buying as call buying, including a $2 million bet that the ETF could plunge 15% during the next three months.

"This morning, when the ETF was trading at about $185, there was a buyer of 7,000 of the November 176/157 put spreads, paying about $3.11 for that," Nathan said. "The trader can make about $15.89 [per contract] all the way down to $157. That would be down 15% from the trading level here."

If the ETF does trade all the way down to that $157 level by November expiration, this trader stands to make $11.2 million on this bet. That could be a tremendous short, or a very lucrative hedge against a portfolio with heavy long tech exposure.

If it is a hedge, Nathan thinks there are plenty of reasons this could turn out to be a prescient insurance buy.

"What I think is really interesting, is that this was massive support all the way from the lows in 2016, and when it broke last year, we had a meaningful break. But what happened here? This trend line, which was support, is now resistance. In these two [recent] highs, we have failed – over the last year – to break out above that prior level.

"I think it does make sense, when we get to these relative highs, to start taking some gains in these mega caps, or thinking about taking some cheap-dollar protection in the options market."

The Nasdaq 100 ETF was up 2% on Tuesday.