A massive move away from the momentum stocks that have dominated much of the last decade has come in part because investors have grown less fearful of an impending downturn, according to Goldman Sachs.

Over the past few weeks, momentum shares, or those showing consistent gains over the past six to 12 months, have swooned at a level rarely seen in market history. The group has tumbled some 14% since Aug. 27, the worst move since the bull market began in March 2009 among the top 1% of the biggest slides ever, according to Goldman.

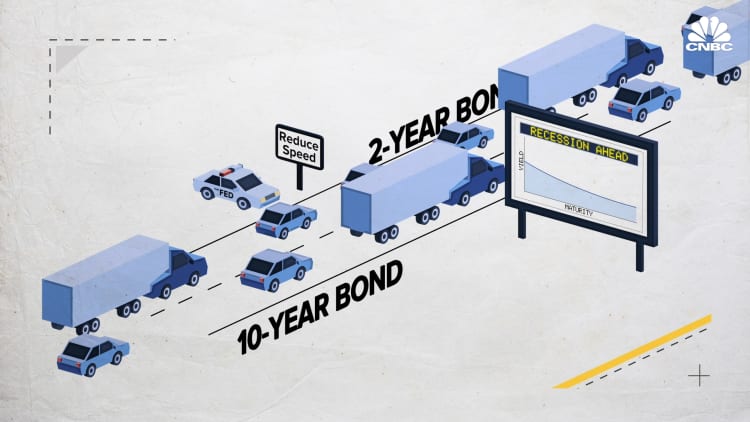

The drop has come at the same time as government bond yields have moved in the other direction, jumping about a quarter percentage point off, in some cases, historic lows. The momentum move reversed a sharp gain the group had seen in the early part of August.

Goldman strategist Ben Snider said such trends in momentum stocks — in this case, defensive sectors used to brace against an economic downturn — are common when investors anticipate steady economic growth ahead, even at a relatively modest pace.

"Perceived improvement in US-China trade negotiations and better-than-feared economic data helped ease investor concern about an impending recession, lifting bond yields and sparking the market rotation," Snider wrote in a note to clients.

From a strategic standpoint, Snider said such moves generally mark a cycle end, not a brief shift destined to move back the other way.

"Sharp Momentum drawdowns similar to the one that has taken place in the last two weeks usually mark the end of the Momentum rallies rather than tactical buying opportunities," Snider added.

Goldman is recommending a basket of 49 that trade at relatively low valuations to earnings and don't have major exposure to the ongoing tariff battle between the U.S. and China. Leading names in that group include Synchrony, CBS, Delta Air Lines, Cimarex and Ameriprise Financial.

The approach does not anticipate a rebound in the value stocks that have fallen out of favor with the market.

"More than valuation dispersion, the path of economic growth will be the key determinant for Growth vs. Value performance in the near future," Snider wrote. "Historically, Value stocks have fared best in periods of very strong or very weak economic growth. In contrast, during periods of positive but modest growth, investors tend to favor the Growth stocks able to generate idiosyncratic growth in excess of the economy."

Investors wanting to play momentum likely will have to be patient.

The group is not sector specific and has swayed back and forth between cyclical and defensive sectors. Major market averages are nearing record highs amid a switch back to risk.