The digital age is reaching all corners of business, and one New York start-up is offering a secured way to gain exposure to gold by tethering the yellow metal to cryptocurrency.

Paxos, a privately held financial institution that provides a way to move between physical and digital assets, has launched a tokenized version of the precious metal called PAX Gold. CEO Charles Cascarilla, who co-founded the firm in 2012, told CNBC on Monday that Paxos is a safe platform for both individual and institutional investors to buy the commodity.

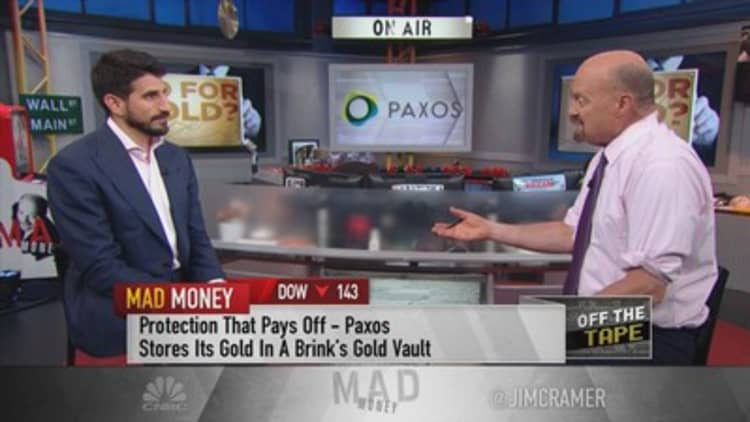

"We're really a technology firm at heart, and so we're trying to give you the confidence of a bank, but the innovation of Silicon Valley," he said in a sitdown with Jim Cramer on "Mad Money." "And that's just different from, I think, most institutions that are in the banking world today."

The price of gold has gained nearly 15% this year, climbing above $1,505 on Monday, and gold stocks such as Barrick Gold and Agnico Eagle Mines have run more than 26% and 38%, respectively, this year.

But Paxos' digital asset, backed by physical gold on the blockchain, is a modern twist to invest in the space. Each token is equivalent to one troy ounce that is liquid and can be converted into greenback or unallocated gold in a Loco London unallocated gold account, according to the company.

Cascarilla recommends users buy a tenth of an ounce, or $150 minimum at current prices.

"I think what's really unique about Paxos is that we're a trust company" with an independent board and auditor and being regulated by the New York State Department of Financial Services, Cascarilla said. "So we're regulated just like a bank, and the reason that's important is you're not just trusting us because we say you should. You're trusting us because we're regulated, we have oversight."

WATCH: Cramer sits down with Paxos CEO Charles Cascarilla

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com