WeWork is deciding how best to position itself to potential investors as it works to get its on-again, off-again IPO back on track.

The company gathered employees for an all-hands meeting on Tuesday, where executives were said to discuss the status of the IPO, sources told CNBC's Leslie Picker. Those sources said WeWork's top brass has determined that the company needs to sharpen its story before it starts its investor roadshow.

In a webcast with employees, WeWork CEO Adam Neumann said he had been "humbled" by the IPO stumbles and admitted he needed to learn more about running a public company, the Financial Times reported, citing sources familiar with the situation. Representatives from WeWork declined to comment on the all-hands meeting.

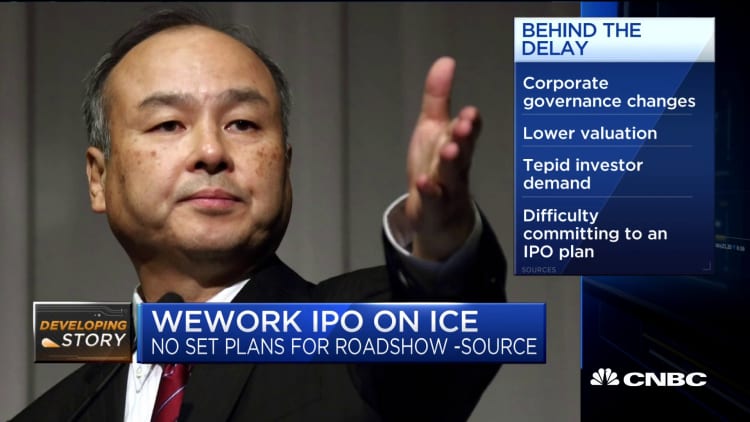

It comes as the We Co., WeWork's parent company, moved this week to delay the IPO, reflecting the continued skepticism around its corporate governance and dwindling valuation. No plans have been set on how long it will be delayed for, but the We Co. may decide to postpone the offering until October.

WeWork said in a statement on Monday that it expects the deal to be completed by the end of the year.

The company faces added pressure to complete the deal before year's end, lest it risk missing out on an expected $3 billion raised in the offering, as well as a $6 billion credit facility with JP Morgan and other banks, which is set to expire on Dec. 31. The funding is needed to support WeWork's continued operations, as the company lost more than $900 million in the first six months of 2019. The risk is that market conditions could turn worse and investors would be even more nervous about a business model that has not been tested during a recession.

WeWork has attempted to assuage investor concerns by making changes to its governance structure. Last week, in an amended S-1 filing, the company said it would curb Neumann's voting power, among other changes.

-- Leslie Picker contributed to this report.