Five makers and distributors of opioid painkillers are in discussions with state attorneys general over a potential settlement worth about $22 billion in cash, and more in drugs and services, according to people familiar with the situation.

The possible deal comes days before the start of the first federal trial seeking to hold industry to account for the epidemic.

Three major drug distributors — McKesson, AmerisourceBergen and Cardinal Health — are in discussions to pay $18 billion, while drugmaker Johnson & Johnson has offered $4 billion, according to the people, who declined to be identified because the talks are private. Teva Pharmaceuticals is in talks to contribute at least $15 billion worth of drugs, with more value coming from some of the five companies in the form of drugs and services, the people said.

The discussions were first reported by The Wall Street Journal and Bloomberg, which noted the money would be paid in increments of $1 billion a year. An official agreement hasn't yet been reached. One sticking point, the people say, is over fees for attorneys representing some of the plaintiff counties.

"We're open to a reasonable settlement," J&J Chief Financial Officer Joseph Wolk said in an interview Tuesday on CNBC's "Squawk Box," before the reports of its $4 billion offer. "Our drugs were less than 1% of the market share of all outstanding opioids, so we want to make sure it's in proportion, but where it makes sense for all stakeholders, we'll look to have a settlement."

News of the discussions comes as jury selection was set to get underway Wednesday in Cleveland, before opening arguments in the federal trial Oct. 21. Some state attorneys general asked the judge in the case to delay the trial as they work on a settlement, but their request was denied, according to The Washington Post.

Some of the defendants also filed a motion Wednesday to postpone the trial "due to eve-of-trial prejudicial publicity," according to the case docket. The motion, though, is sealed.

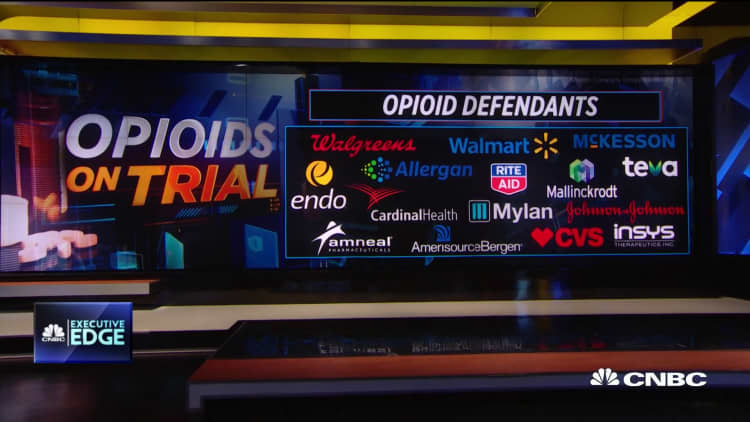

More than 2,000 counties, cities and states have sued more than a dozen drug companies, distributors and pharmacies, alleging the industry helped create the nation's opioid epidemic. The trial set to begin next week involves just two Ohio counties, considered the first "bellwether" trial for the rest of the cases that have been consolidated into a multidistrict litigation centered in Cleveland. The state cases are proceeding separately.

The settlement discussions with the five companies don't include several other companies named in many cases, including drugmakers Mallinckrodt and Endo International, and pharmacies including CVS Health, Walgreens and Walmart. Nonetheless, Endo's stock rose 21% Wednesday afternoon, while Mallinckrodt's rose almost 8%.

Shares of drug distributors also rose.

A "settlement would remove [an] overhang and make [the] group ownable again," Jefferies analyst Brian Tanquilut wrote in a note about the drug distributors.

The numbers, generally, are lower than many on Wall Street had projected. In a note in August, Morgan Stanley estimated base case liability for Cardinal Health at $8.2 billion, McKesson at $10.9 billion, and AmerisourceBergen at $6.9 billion. The firm's estimates for J&J and Teva were $5.9 billion and $4.7 billion, respectively.

Some on the state attorneys general side are pushing for Teva to contribute cash in addition to drugs, according to one person familiar. The company has a significant amount of debt and doesn't have the financial firepower of the distributors and J&J.

Teva declined to comment, as did AmerisourceBergen. Cardinal Health and McKesson didn't respond to requests for comment.