The earnings parade continues next week, when a series of big tech titans report.

Alphabet and Facebook are among the marquee names, but one combatant in the streaming wars could push its way into the spotlight when it kicks off the big week of reports bright and early Monday morning.

"Taking a look at the last eight quarters, AT&T has averaged moves of just under 5%. The options market is expecting a move somewhat more modest than that. Right now, it's implying a move of about 4.5%," Optimize Advisors President Michael Khouw said Thursday on "Fast Money."

The stock has performed admirably in 2019, surging more than 30% on the year. It will be a tough task to keep that momentum going through Monday's report barring some big-time numbers, and options traders don't seem convinced a show-stopping beat is in the cards.

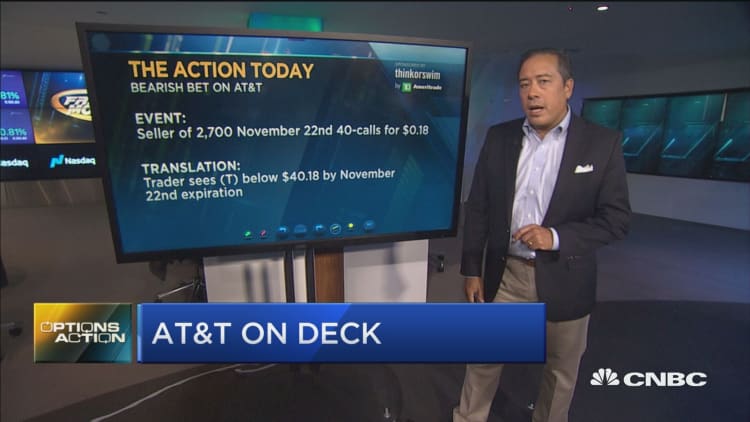

"Despite how the stock has traded this year, a lot of the trades were bearish. Some of them were more neutral in nature," said Khouw. "We saw a seller of 2,700 of the Nov. 22 weekly 40-strike calls for just $0.18. So the seller of these calls is obviously making the bet that the stock's not going to rally through that 40-strike price, certainly not by the amount of premium they're collecting."

As Khouw would point out, that amount of premium isn't too flashy, but this bet has a high probability of paying off. Over the last 44 of AT&T's reported quarters, selling calls at least 8% out of the money — as this trader is doing — has been profitable 41 times. So, while this trade isn't exactly a get-rich-quick scheme, it's a solid bet.

It's also possible that this trader is selling these against a long position in AT&T as some extra insurance.

"We can see that the stock has obviously performed very well so far this year, but basically, [this trader] is drawing a line in the sand and saying, 'This is the level where I would be willing to get out,'" said Khouw.

AT&T was trading slightly higher in Friday's session.