CNBC's Jim Cramer on Tuesday railed against automated trading that he said is to blame for the unwarranted spikes in a number of cyclical stocks.

Shares of Caterpillar have surged 10% since reporting disappointing third-quarter results and cutting guidance about two weeks ago. Union Pacific and FedEx have both rallied more than $10 in the three trading days of November.

"It's a rotation based on the idea that the economy's in better shape than the bears thought," the "Mad Money" host said.

Cramer blamed the errant jumps in the transport stocks on machine trading, calling the buying "robotic."

"Real human buyers wouldn't pay up eight points for FedEx on no news, unless they think there's going to be some sort of takeover, which there probably isn't. Real buyers work an order. They wait for sellers to come to them," he said. "Instead, these machine buyers they blitzed all the sellers all the way up, and you have to believe they didn't even attempt to try to get a good price for their customers."

There are both advantages and disadvantages to what's known as machine or automated trading, where computers monitor and execute transactions for traders based on a set of established rules.

As far as the pros, automated systems can curtail emotional trading, assess trades based on historical market and ensure more disciplined trading, among other things.

On the cons side, the machines are at risk of performing poorly and must also be monitored. Cramer contemplated that the real problem is the inability of the machines to "moderate their own buying."

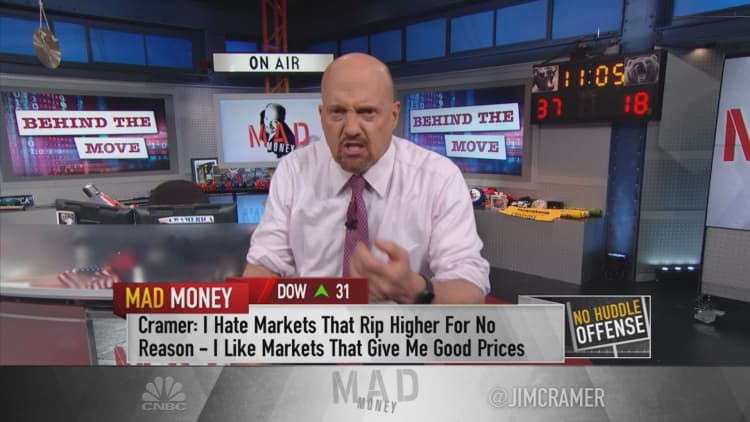

"They simply buy stock too fast, way too fast for the sellers to be able to offer new shares," he said. "Now, I'm often criticized for only caring about these programs when the market goes down, [but] that's complete nonsense ... I hate it when stocks go up like this on nothing. It destroys what makes the American market so great: deep liquidity that leads to real price discovery."

It's one reason Cramer thinks individual investors tend to stay away from individual stocks because of the difficulty to find reasonable prices to buy in.

What goes up eight can go down just as much, he said.

"I hate markets that rip higher for no reason. I like markets that give me good prices," the host said. "No one lifts a finger to stop it, because the big institutions care more about racking up fees than they do about ensuring orderly markets. You know what: the whole darned thing is a travesty."

Disclosure: Cramer's charitable trust owns shares of Caterpillar.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com