Wall Street has shifted into reverse.

Traders have fallen in love with value stocks again as high-growth stocks have been given the boot in a "capricious" market, CNBC's Jim Cramer said Tuesday.

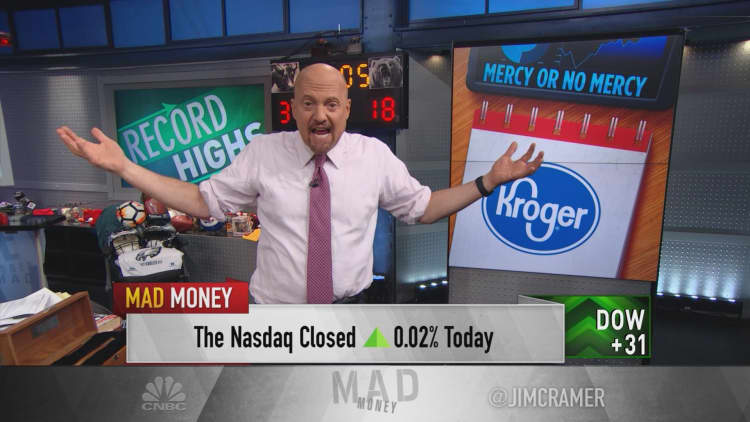

The "Mad Money" host contended the "market's showing mercy toward some stocks and no mercy toward others."

Cramer pointed to the stocks of Kroger, Uber, Marriott and Starbucks, among others, to make his case after a mixed trading day where the Dow Jones Industrial Average advanced about 30 points, or 0.11%, to 27,492.63, the Nasdaq Composite bumped up 0.02% to 8,434.68, and the S&P 500 slipped 0.12% to 3,074.62.

Shares of Kroger skyrocketed more than 11% after management guided full-year 2020 earnings between $2.30 and $2.40 per share during its investor day. Analyst consensus pegged earnings per share at $2.19, according to FactSet.

The grocery chain as of Monday had been down more than 9% on the year, but managed to flip its fortunes in just one trading day. Kroger was an "also-ran" behind tough competition from Costco, Walmart and Amazon, Cramer highlighted.

"Considering all the competition, that's extraordinary, and it makes sense that Kroger's stock roared higher," he said. "When I spoke to CEO Rodney McMullen this afternoon ... he made it clear that many of his long-term initiatives ... to win back customers and retain customers are now working, especially the Restock Kroger plan."

Uber, however, got "no mercy" from traders, Cramer said. Shares tumbled nearly 10% in the session, now down more than 32% since the company went public earlier this year.

The ride-hailing company reported a "decent quarter," but it was marred by the amount of money it's losing on Uber Eats in a tough food-delivery landscape, Cramer said. On top of that, Uber's lockup period on insider selling expires on Wednesday, which could spell more doom for the equity.

"Perhaps as much as a billion shares will suddenly be free to trade. Given that the company seems committed to losing money in Uber Eats, I suspect that many of these investors — with a cost basis below $25 — will be eager to take whatever profits they can get and watch the stock go down from here."

The market on Tuesday showed mercy to Marriott, which rose 2.71%, though it missed earnings estimates in its September report, Cramer noted. As for Starbucks, the stock fell for the third straight trading day on a shade down in its near-term outlook, he added.

"At this pace, value will soon be regarded as expensive, and the growth stocks" that were shown no mercy will look cheap, Cramer said, "unless we get a trade deal or the economy hits a roadblock, at which point the money ... [will] go right back into the growth names that they are showing no mercy to at this very moment."

Disclosure: Cramer's charitable trust owns shares of Amazon.com.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com