BETHEL PARK, Pa. – At Ameri-Source Metals' machine shop outside Pittsburgh, stacks of graphite stubs have begun to pile up in a quiet corner.

Founder Ajay Goel said the customer who typically buys the stubs – a multinational chemicals company – now only needs one-fourth of the amount he used to produce. As a result, the machines have been idled and the workers who serviced them, laid off.

Goel has lived through many economic cycles before. In 1995, he founded the business, which cuts graphite and steel into bespoke shapes for industrial, chemical and defense companies, after being laid off from U.S. Steel. And with orders slowing – and an additional $3 million in tariff costs – he's borrowing from a playbook he refined in leaner times.

"I think the first place will be where we make sure we really cut down on costs," Goel told CNBC. "That particular cost-cutting started almost like six to eight months back."

Goel says the company is also trying to deepen its customer relationships and pressing the pause button on certain areas of expansion. "We would like to replace machines faster, which we are not doing."

Heading into 2020, stories like these could amount to big trouble for President Donald Trump's reelection chances. Ameri-Source sits at the edge of deep-blue Allegheny County, but most employees commute from surrounding counties that backed Trump in 2016. It's a familiar position for companies across the Rust Belt, the corridor of heavy industry whose blue-collar workers supported Trump's manufacturing-friendly message and were critical to his swing state wins.

Flooded with resumes for jobs that don't exist

Since Trump's inauguration, companies have added more than 400,000 manufacturing jobs across the United States. The furniture, food and beverage, and electronics industries have cited continued growth.

But national manufacturing employment appears to have peaked in August, with the revival reversing sharply this year in four swing states that were instrumental to Trump's election in 2016.

From January to September, the states bordering the Great Lakes have lost more than 25,000 manufacturing jobs: Pennsylvania lost 8,100; Ohio lost 6,000; Michigan lost 6,500; and Wisconsin lost 4,700.

Goel says he's been flooded with resumes over the last year for jobs he doesn't have available.

"Western Pennsylvania has lost a pretty big chunk of workforce," he said.

The declines are largely thanks to major, multinational companies like U.S. Steel, 3M, General Motors and Kennametal, which have announced restructurings and plant closings based on overseas weakness and trade uncertainty.

Peter Boockvar, chief investment officer of Bleakley Advisory Group, says a "Phase One" trade deal between the U.S. and China, and the removal of several tariff tranches, may offer a reprieve. But there are still concerns that stalled growth abroad could weigh on American companies.

"As long as U.S. manufacturers' overseas end markets are seeing sluggish growth, such as in Europe, China and the rest of Asia, any respite might only be temporary," Boockvar said. "Only the full elimination of the tariffs, I believe, will give companies visibility with their business."

The weakness of the blue-chip manufacturers is starting to spill over to small- and medium-size suppliers.

Manufacturing activity across the country has contracted for three months, according to closely watched ISM data. In the Midwest, the slowdown has been more severe. The Chicago Purchasing Managers Index shows backlogs dropping to a level touched briefly four years ago but last sustained during the financial crisis.

In Wisconsin, Church Metal Spinning welder Drew Savinski has seen his to-do list shrink firsthand.

"In January through May, this was completely full, like I couldn't even write any more," Savinski said of the whiteboard in his workspace that lists three projects. "But it's toned down a little bit."

Church Metal Spinning's customers range from industrial engine makers, producers of small plastics and architectural firms. Company president Mark Verhein says he's focusing on retooling the company toward new and more reliable customers.

"We used to make offering plates" for church money collections, Verhein said with a laugh, referring to the company's nimbleness. "We now have 0% of the liturgical market."

Verhein said he sees a recession afoot in "pockets" of his customers' business, although he's optimistic the slowdown is temporary. As his employees' hours slow, Verhein is looking for ways to educate and retrain workers so he can retain them for when demand picks back up. But he acknowledges their paychecks might be affected in the meantime.

"We continue to give merit increases to our employees; our quarterly bonuses are lower than they were," Verhein said in his factory outside Milwaukee. "People aren't necessarily getting 40, 50, 55 hours per week, so overtime is down."

In Ohio, Timken Steel is furloughing 1,500 employees for one week a month, in an attempt to save money as demand softens but to retain access to its trained workers.

Bob Harper, president of the local chapter of the United Steelworkers representing Timken workers, says when those employees bring home 25% less than they used to, the area economy suffers.

"You're not buying houses, not buying trucks, not buying new automobiles," Harper said near Capitol Hill, where he recently lobbied lawmakers. "They're looking at what the future is."

Stark County, Ohio, where Timken Steel and the Timken Company have been major employers for decades, swung for Trump in 2016 after backing Democrats during the three previous presidential races. Harper says the economic pressures may swing the county back as the industry heads, in his view, toward a recession.

"We're close," Harper said. "Everything [Trump] promised us is not there."

Trump campaigns in the Rust Belt

Trump's reelection hopes largely hinge on how well he will do in the Rust Belt, as his campaign focuses on winning the Electoral College. According to state polls, the president is in a much better position in Michigan, Pennsylvania and Wisconsin than he is in national surveys, where he routinely lags behind Democratic front-runners such as Joe Biden, Bernie Sanders and Elizabeth Warren.

As the Trump reelection effort focuses on the Rust Belt and winning the Electoral College next year, his campaign is unbowed by the weakness in recent data. Tim Murtaugh, the campaign's communications director, boasted about gains in overall manufacturing jobs while pressing Democrats to back one of the president's key trade initiatives — the United States-Mexico-Canada Agreement.

"If Democrats in Congress would move on approving the USMCA trade deal with Canada and Mexico — which has enough votes to pass — we would see even more good economic news," he said.

Campaign travel schedules tell another story. As 2020 approaches, Trump has held rallies in Pittsburgh and Grand Rapids, Michigan; Vice President Mike Pence visited manufacturer U-Line in Kenosha, Wisconsin — the county Trump won in 2016 by the slimmest margin to secure the state's 10 electoral votes.

Trump administration officials have offered mixed messages on how they are viewing the industry.

Jerome Powell, chairman of the Federal Reserve, said the U.S. consumer remains financially healthy, while heavier industry slows.

"Business investment and exports remain weak, and manufacturing output has declined over the past year," Powell said at his October press conference. "Sluggish growth abroad and trade developments have been weighing on those sectors."

Trump's top economic advisor, Larry Kudlow, told Fox News in early October he had concerns about manufacturing, and the White House was watching it "carefully." In an interview with CNBC, the National Economic Council director cited a few external forces weighing on the industry, including Powell's actions.

"The aftermath of severe monetary tightening. The slump in Europe. The strikes at GM. I'm not going to call it a strike, but the problems," Kudlow told "Squawk on the Street." "That stuff cuts into manufacturing."

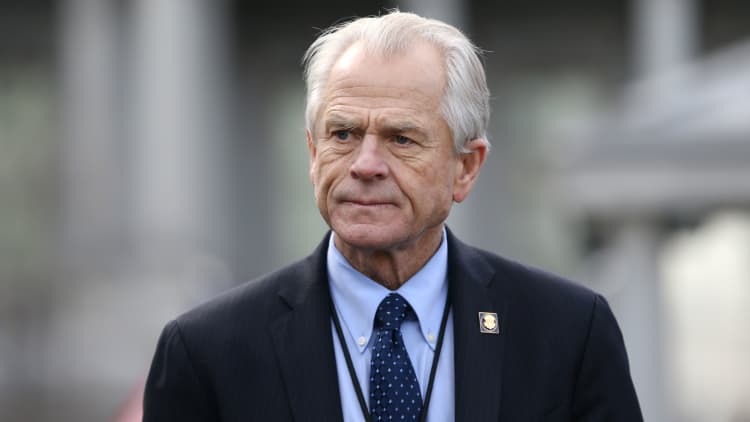

Peter Navarro, who leads the White House Office of Trade and Manufacturing and Policy, called the data and the experiences of the business owners CNBC interviewed "anti-Trump fake news" and cited the recent highs in the Dow Jones Industrial Average.

When asked in a Sept. 30 interview on CNBC's "Squawk Box" about the seeming erosion in manufacturing jobs in the Rust Belt, Navarro was defiant.

"I don't know why you're going down this path" of questioning, Navarro said. "Manufacturing is strong as a rock."

CNBC's Stephanie Dhue, Whitney Kzasieck and John Schoen contributed reporting.

Correction: A logo in the video was updated to reflect that Timken Steel is being discussed.