The largest hedge fund in the world has reportedly staked more than $1 billion that global equity markets will fall during the next three months.

The wager placed by Ray Dalio's Bridgewater Associates would pay off for the firm if either the S&P 500 or the Euro Stoxx 50 or both decline, people familiar with the matter told The Wall Street Journal.

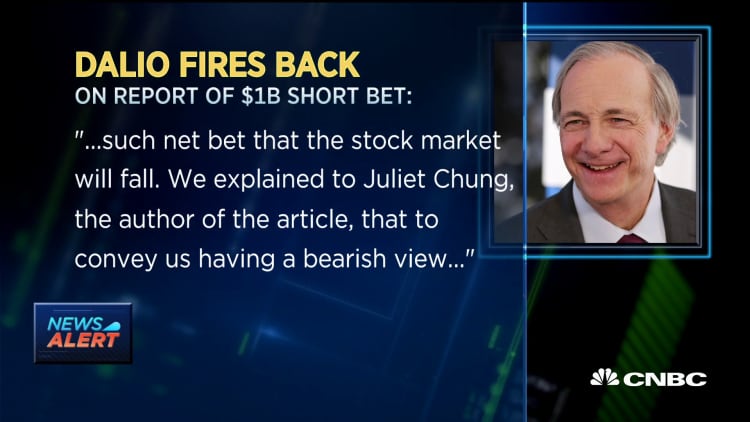

Dalio, however, took to social media later on Friday to dispute the report, saying on Twitter that "It’s wrong. I want to make clear that we don’t have any such net bet that the stock market will fall."

"I believe that we are now living in a world in which sensationalistic headlines are what many writers want above all else, even if the facts don't square w/ the headlines," he added. "You can believe me or you can believe The WSJ writer."

Wall Street Journal spokesman Steve Severinghaus defended the paper's reporting in a statement to CNBC:

"The Journal's article is based on interviews with multiple sources and we stand by the conclusions we reported," Severinghaus said in an email.

"The article does not report, as Mr. Dalio says, that Bridgewater has a 'net' bearish position on the stock market. The article made clear that the trade could be a hedge for the firm's significant long exposure to equity markets, among other possibilities," he added.

The Journal said in its initial report that the bet uses put options — assembled over months by Goldman Sachs and Morgan Stanley — that give investors the option of selling stocks at a predetermined price by a given date.

The firm paid about $1.5 billion for the contracts, about 1% of Bridgewater's $150 billion in total assets under management, the report said.

"Though we won't comment on our specific positions we do want to make two things clear," Bridgewater said in a statement to CNBC. "First, the way we manage money is to have many interrelated positions, often to hedge other positions, and these change often, so that it would be a mistake to look at any one position at any one time to try to deduce the motivation behind that position."

"Second, we have no positions that are intended to either hedge or bet on any potential political developments in the U.S.," the firm added. Though Bridgewater wouldn't confirm the motivation behind the bearish bet, many investment strategists and investors alike have grown wary in recent weeks as all three U.S. equity indexes clinched new all-time highs.

Dalio's outlook

The records have come despite what many have categorized as decent-at-best trade developments between the U.S. and China, with both nations still haggling over a preliminary agreement.

Doubts about a trade truce have crept higher over the last week, especially on the heels of the U.S. Senate's unanimous vote on Tuesday to support Hong Kong's anti-government protesters. China, in response, said the U.S. was interfering in internal affairs.

The bond market, however, appears to have already priced in diminished prospects for a deal as October's marked uptick in yields has given way to a partial retracement in November. The Dow Jones Industrial Average fell as much as 258 points on Wednesday after Reuters quoted sources as saying a trade deal may not be completed by the end of this year.

Dalio has been less than rosy in his projections for future relations between Washington and Beijing.

"There is a trade war, there is a technology war, there is a geopolitical war, and there could be capital wars. And how that's approached is going to determine what our futures are like," Bridgewater's billionaire founder said last week.

"I honestly don't know how it will be approached. We want to be optimistic," he added.

— Click here for the original Wall Street Journal report.

— CNBC's Leslie Picker contributed to this report.