The potential impeachment of U.S. President Donald Trump does not pose a risk to markets, according to UBS.

Last week, House Speaker Nancy Pelosi directed the House Judiciary Committee to draft articles of impeachment against the president following a series of public hearings detailing the administration's conduct regarding foreign policy in Ukraine.

Thus far, markets have shown little reaction to developments in the impeachment inquiry, and this could be down to the unlikelihood that the Republican-controlled Senate will convict.

"The UBS U.S. Office of Public Policy regards impeachment as likely, as it can be passed in the House without any Republican votes, but considers a Senate conviction unlikely, as Republicans hold a majority in that chamber and a two-thirds supermajority would be needed," UBS Global Wealth Management CIO Mark Haefele said in a note to investors on Monday.

Senate Republicans have rallied behind the president throughout the inquiry, consistently adapting their defenses in response to each piece of evidence presented by senior officials and diplomats in sworn testimonies before the House Intelligence Committee.

As a result, UBS does not regard uncertainty around the process as a source of market risk. However, the upcoming election in November 2020 could be pivotal, impacting key equity sectors such as technology, energy and health care, the Swiss lender projected.

Trump has previously suggested that tech giants could face scrutiny from antitrust regulators, and a Department of Justice review is underway.

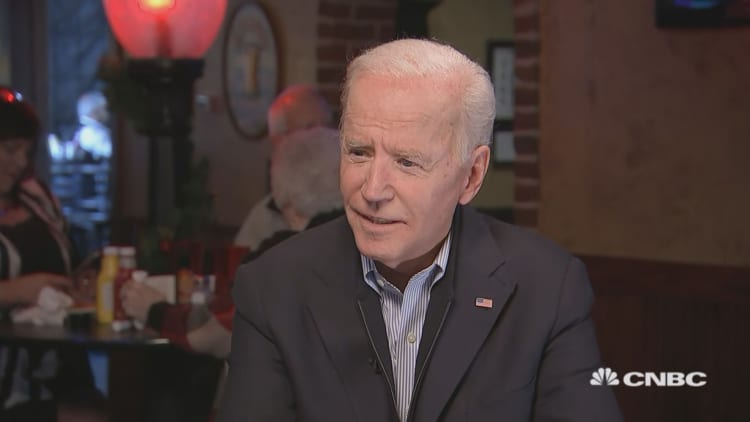

There is a polarization of views within the Democratic contenders, with frontrunner Joe Biden urging further investigation before action is taken while Senator Elizabeth Warren has published a plan to break up "big tech."

The Trump administration has loosened environmental regulations on energy companies, but this trend would almost certainly be reversed under any potential Democratic president. Warren has gone as far as to propose an out-and-out ban on fracking by executive order.

On the health care front, Trump has set out to weaken the Affordable Care Act (ACA) which is still favored by the Democratic field, albeit with varying views on the extent to which greater provision of public health care is required.

There is also a broad consensus among the hopefuls that a form of restriction on drug pricing is necessary, a position which enjoys some bipartisan support and could hurt the health care and pharmaceutical industries.

"So, while the U.S. is one of our preferred markets, specific sectors could face volatility — or even longer-term headwinds — as the election campaign progresses," Haefele added.

"Diversification can help reduce these risks, alongside sector-specific strategies if certain threats mount."