If anyone knows how to get to $10,000 with sure, definite steps, it's Grant Sabatier of online personal finance community Millennial Money. Just about 10 years ago, a then 20-something Sabatier was broke, and the future looked bleak.

Today, Sabatier, who turns 35 this month, is worth more than $1 million and has just published his first book, "Financial Freedom."

Money is only stressful if you don't build a relationship with it, Sabatier says. To do that, he recommends looking at your net worth every day. It will be stressful for a while, he admits.

"Then, at some point, maybe the 30th or 40th day, you log into your account, you are used to it," he said. "It becomes less stressful and you don't fear it as much."

More from Invest in You:

Surprising purchases that actually qualify for pretax savings

The top 10 rules for gift-giving

6 steps to take now for a strong financial new year

You can absolutely get to $10,000 without a side hustle. "It would depend on salary," Sabatier said. It all comes down to spending habits and aggressively funneling money into investments.

Cutting costs doesn't have to go on forever. "Just make a couple of these changes for the next six months to get to $10,000," Sabatier said. "Then see how you feel.

"When you get to the $10,000 level stop and look around," he added. "Take the time to reflect and see if one tradeoff was worth it or not."

1. The need for speed

One of the hardest things about getting started is that you don't yet have the essential habits. When you're building the habits, growth is slower. "The smaller your investment balance, the more slowly your money grows," Sabatier said.

The first 90 days are key, because that's where you need to work hard to build momentum.

The longer you take to get there, the harder it will seem. Saving up $10,000 in five years will seem like a burden. "If you do it in a year, you'll say, 'Wow! In five years, I could have $50,000,'" Sabatier said.

2. Save more by a tiny amount

Next, increase that amount frequently: every 30 days. "It's less painful," Sabatier said.

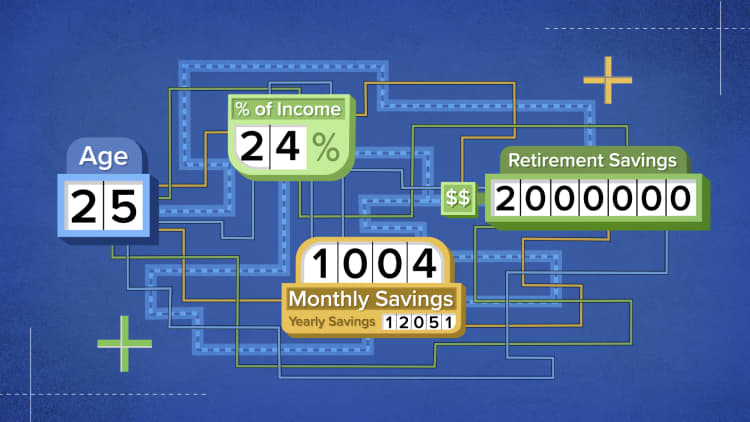

You can think about money in one of two ways: in terms of dollars, or in percentages. Using the percentage lets you trick yourself into saving more without feeling it as an immediate hit to your wallet.

That's because you cannot buy anything that costs 1%. Instead of saying you'll save $300 more each month, an amount you can easily understand and be tempted to spend, express your savings goals in these tiny increments.

"Go into your 401(k) every 30 days and change your contribution amount," Sabatier said. Depending on the platform and the plan design, you may be able to set your increase automatically.

3. Invest your side hustle cash

Sabatier made $60 taking care of his neighbor's cat, among other side hustles. Instead of spending it, he deposited it right away into his brokerage account.

That is another way to manually increase your savings. Take any extra money, whether it's a few dollars you find around the house or a forgotten $10 someone returns to you. Instead of treating it as surprise cash to buy lunch, invest that money.

"Every dollar you make on the side, invest as quickly as possible," Sabatier said. "Because you want to get the extra money you're making to start working as quickly as possible."

4. The roundup strategy

Contrary to popular recommendations, Sabatier checked his net worth daily. If the number was $7,987, he'd come up with $13 to invest, just so he could round it up to an even $8,000.

"I'm a little OCD," he said.

His no-fee method was to deposit bits of extra cash into a money-market account at Vanguard. When he had accumulated enough, say $200, he'd invest it in low-cost index funds.

The point is to use mindset to get extra money into your investment account.