It was the best-performing stock in 2018. It was the best-performing stock in 2019.

And it's off to a stellar start to the new year, too, although it was down 1.5% to $48.35 in Friday's premarket amid a broad market decline stemming from the U.S. airstrike that killed Iran's top military commander.

Advanced Micro Devices kicked off 2020 with a strong 4% rally on the first trading day of the year, one that took the stock to an all-time high for the first time in two decades.

TradingAnalysis.com founder Todd Gordon said Thursday the charts are pointing to an even bigger rally for AMD.

"If you go back all the way to 2000, you'll see it just recently broke out of that 20-year period consolidation," Gordon said on CNBC's "Trading Nation," noting that AMD has broken above the $35 level and any pullback to that point is "healthy."

On a daily chart of AMD, Gordon emphasized that a "well-established uptrend" suggests there's more room to run for the stock.

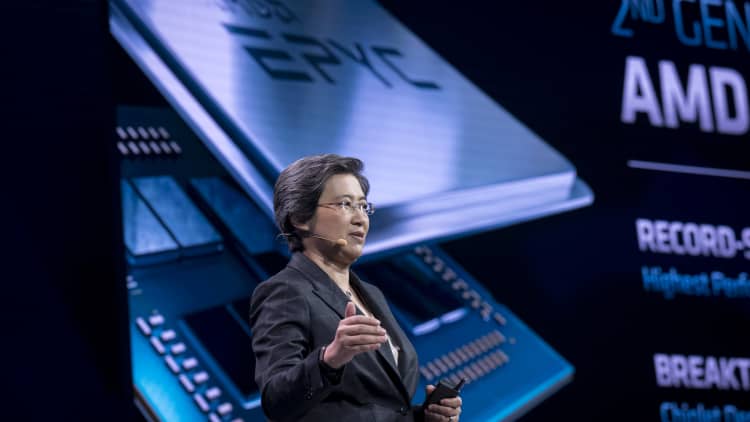

The stock's breakout from the 20-year consolidation that Gordon noted is also a result of CEO Lisa Su's management of the company, according to Chantico Global CEO Gina Sanchez.

Su's tenure as CEO has actually strengthened the stock's fundamentals, Sanchez said.

"A lot of this big runup that you've seen is actually building off some of that momentum that she has managed to create," she said in the same interview. "They had solid Q3 2019 numbers with 9 percent growth and they are expected to continue to take market share away from Intel."

But AMD may have one weakness: its valuation.

"I think the Achilles' heel continues to be the valuation," added Sanchez. "The fundamentals, however, are extremely strong."

Shares trade at 42 times forward earnings, more than twice the multiple on the S&P 500. The stock has rallied over 180% in the past year.