Biotech is headed for another big breakout.

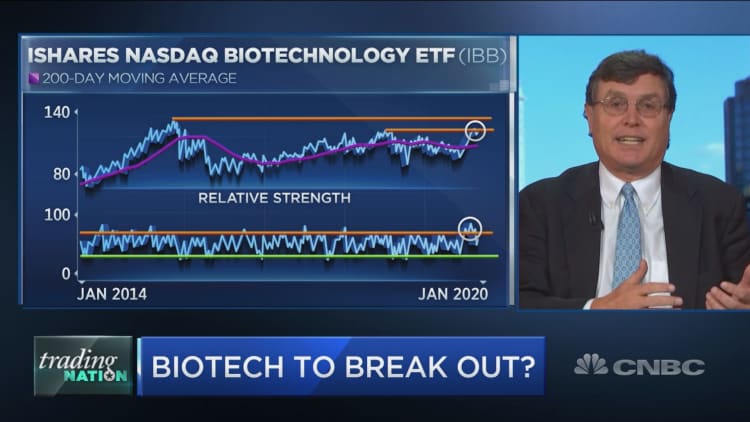

That's according to Matt Maley, chief market strategist at Miller Tabak, whose chart analysis shows the iShares Nasdaq Biotechnology ETF (IBB) on a straight shot back to its all-time highs from 2015.

"In October, ... it broke above its summer highs and saw this really nice rally into early December. At that point, we kind of put a cautionary yellow flag on the group because it became very, very overbought," Maley told CNBC's "Trading Nation" on Thursday.

After a brief pullback into early December, "it's starting to rally again, and that pullback worked off that overbought position quite a bit, so that's a very nice setup," Maley said. "It didn't really have to pull back very much to work off that overbought position, so we're creating a nice higher low."

If the IBB can now charge through its December highs — which happened to mirror the ETF's double-top highs from 2018 — "that's going to give it a great breakout and take it right back up to its all-time highs from 2015," Maley said.

A move to the IBB's 2015 record of $133.60 a share represents a more than 10% gain from where it was trading early on Friday, around $121.40.

"You break above that, it's going to have a nice run," the strategist said. "Now, we do have to worry about the election. As that tightens up over the summer, that could cause some problems if the Democrat starts to look like he or she might win, but I think that's several months off and the group is setting up very well on a technical basis for a further run."

Gina Sanchez, founder and CEO of Chantico Global, said in the same "Trading Nation" interview that "the fundamentals definitely support what is happening" with the IBB's trajectory.

"The problem with biotech is it is a really capital-intensive business that takes a long time to come to fruition, but we're actually at a point where you have a lot of potential therapies and new drugs that are very close to coming forward," she said, adding that the success of those new therapies contributed to a robust biotech merger-acquisition cycle in 2019.

"That continued throughout the year and I think that was part of really recognizing all the unlocked value that was sitting in these biotech companies," Sanchez said. "That, plus cheap capital, low interest rates and a lot of money that's sitting on the sideline, that certainly converges to sort of form all of the things that could unlock that product pipeline that's been building for years. But I agree that the sort of outlook for the regulatory environment is the fly in the ointment and you have to sort of watch that."