CNBC's Jim Cramer on Friday said the stock market has reached a level that is "too gleeful for my taste."

The major averages finished the trading day in the red after the U.S. Labor Department said the December jobs report missed forecasts. But the week ended with the Dow Jones Industrial Average up 0.66%, the S&P 500 up just shy of 1% and the Nasdaq Composite up 1.75% after an uncertain week of rising and easing military tension between the U.S. and Iran.

The indexes did, however, all set new highs in the past week as Wall Street readies for earnings season.

"My suggestion is tread carefully going into earnings season," the "Mad Money" host said. "We've tried to take something off the table every day for my charitable trust. I think you should do the same, because this is a good moment for profit-taking."

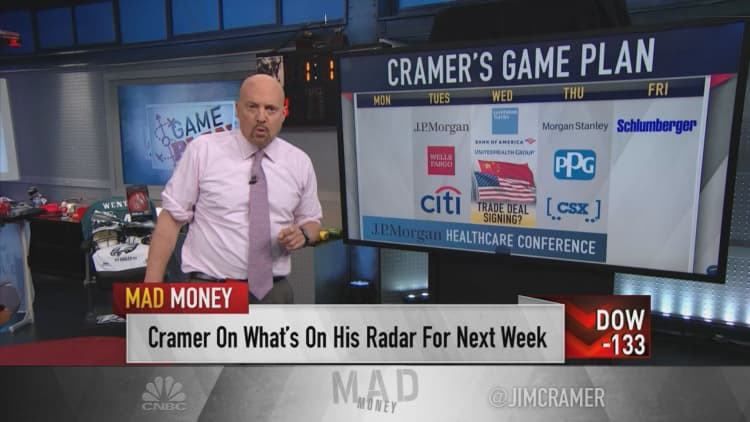

Cramer presented his game plan for the week ahead. Investors will find out if the coming quarterly reports will justify the market's move higher, he said.

"I'm actually glad we got a pullback today, if only because it could help buffer the market against potentially sharper declines if the earnings start to disappoint that we hear next week," the host said. "I hate it when stocks run going into earnings season. Any weakness here will actually give the bulls a better setup."

Monday: J.P. Morgan annual health-care conference

All eyes will be on the largest annual health-care investment conference, which J.P. Morgan will host over three days in San Francisco. More than 450 private and public companies are expected to be on hand for the fair.

"Remember, this conference is where Bristol-Myers told us it was acquiring Celgene last year. This time I'm expecting some startling announcements and new drugs that I'm going out there myself to find out about," Cramer said. "I'll be reporting on it live from San Francisco."

Tuesday: J.P. Morgan Chase, Wells Fargo, Citigroup earnings

J.P. Morgan Chase reports fourth-quarter earnings before the market opens. The bank is expected to record almost $27.9 billion in revenue and $2.35 in earnings per share.

"I bet the numbers will be good, but will they be good enough to justify this move? I think it's incredibly difficult for any company to live up to such lofty expectations at this point," Cramer said.

Wells Fargo also releases a fourth-quarter report in the morning followed by the first earnings call led by new CEO Charles Scharf. Wall Street is looking for $20.1 billion in sales and $1.12 in earnings per share.

"I can't wait to hear what Charlie Scharf ... has to say about how he's re-inventing the business," Cramer said.

Citigroup is expected to report $17.9 billion on the top line and $1.82 of profits per share on the bottom line when it reveals its numbers before the morning bell.

"I want to know if Citi will keep buying back stock now that it's had such a huge run," the host said.

Wednesday: Goldman Sachs, Bank of America, United Health earnings; trade deal signing

Goldman Sachs will give out quarterly results before the market opens. Analysts estimate revenue of $8.5 billion and earnings per share of $5.50.

"I'm a big believer in the company that I worked for at one point in my career. I don't expect to hear anything so amazing that it will propel the stock higher, though," Cramer said. "At least not yet. Goldman has a major analyst meeting at the end of the month. That might do the trick."

Bank of America's fourth-quarter numbers also come out in the morning. The bank is projected to bring in $22.2 billion in revenue and yield 69 cents of earnings per share.

"The company has been putting up consistently good number after consistently good number," Cramer said, but he is "worried about profit-taking."

United Health reports fourth-quarter earnings before trading opens. The managed-care company could rake in revenues of almost $61 billion and profits of $3.77 per share. Cramer expects United Health to beat the estimates and management to raise guidance.

Outside the slate of earnings reports, American and Chinese officials are expected to sign a long-awaited phase one trade deal. The United States promised to reduce import tariffs, and China committed to buying more agricultural goods.

Thursday: Morgan Stanley, PPG earnings

Morgan Stanley is the last big bank to report earnings, which will come before the market opens for trading. The bank is projected to bring in $9.7 billion of revenue and produce $1.03 of earnings per share.

"I think it can go higher, and if the stock sells off after the other banks report, I think you'd want to buy some," Cramer said.

PPG reports earnings in the morning and hosts a shareholder call in the afternoon. The paint supplier is estimated to collect almost $3.7 billion of sales and make $1.34 in earnings per share.

"PPG will give us the pulse of the group," the host said.

CSX reports fourth-quarter results after the closing bell. The railroad company, a key bellwether, is estimated to do $2.9 billion of sales and 98 cents of earnings per share.

Friday: Schlumberger earnings

Schlumberger reports earnings in the morning. Analysts expect to see nearly $8.2 billion of revenue and 37 cents of profit per share.

"We need a 'NABAF' here — 'not as bad as feared' — and then the stock can rally," Cramer said. "The problem is I just don't know if it's possible to get anything positive out of an oil service company in this environment, even with the price of crude up substantially over the past week."

Disclosure: Cramer's charitable trust owns shares of J.P. Morgan Chase, Citigroup, Goldman Sachs and Schlumberger.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com