The White House has started work on a second round of tax cuts even as the budget deficit continues to grow, Treasury Secretary Steven Mnuchin said Thursday.

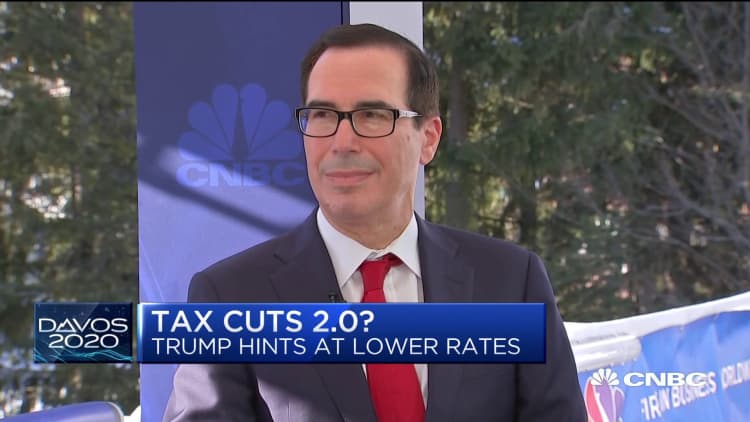

"The president has asked us to start working on what we call 'tax 2.0,' and that will be additional tax cuts," Mnuchin told CNBC during an interview at the World Economic Forum in Davos, Switzerland. "They'll be tax cuts for the middle class, and we'll also be looking at other incentives to stimulate economic growth."

Talk of election year tax cuts comes amid a swelling budget deficit that eclipsed $1 trillion for the 2019 calendar year. In addition, total government debt recently passed $23 trillion, despite President Donald Trump's promises that economic growth would wipe out the deficit and pull down the federal IOU.

Mnuchin maintained that the tax cuts would pay for themselves even as growth has fallen well short of the administration's promises of 3%-4% annually. He did concede that the level of spending needs to be curtailed.

"There's no question that we need to slow down the rate of growth of government spending, because we cannot sustain these deficits growing at these levels," he said.

The White House pushed through a bill in late 2017 that pulled the business tax down sharply and also lightened the load for many individual taxpayers. However, economic growth has fallen below 3%, and the red ink has continued to grow.

Under the plan the administration will advance this time, the cuts will be more targeted to the middle class.

"The president feels that we need to continue to incentivize the middle class, that their taxes have been too high historically," Mnuchin said. "We've had big tax cuts already, and that's an area that we'll continue to look at."

The administration still expects the tax cuts to pay for themselves over a 10-year period, though Mnuchin acknowledged that the reductions were "front-loaded" and thus impacting the deficit more. He also said Trump chose to prioritize rebuilding the military, which also has added to the shortfall.

"The president's economic program is clearly working," Mnuchin said.