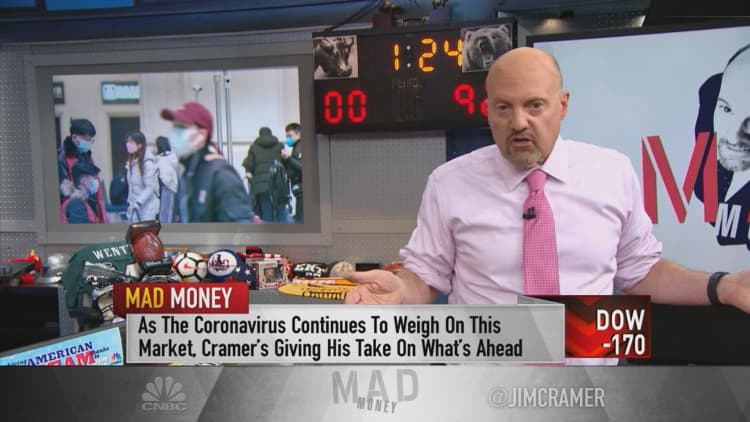

As fears of the coronavirus grow, stock prices are likely to contract and investors should be prepared for buying opportunities, CNBC's Jim Cramer said Friday.

"We've got a huge number of companies reporting next week, but the biggest story by far will be the coronavirus outbreak," the "Mad Money" host said. "If a high-quality stock gets slammed, and that stock has nothing to do with travel or with China, then use the overall decline to pounce on it."

The Dow Jones Industrial Average finished the week of trading in the red as worries about the spreading deadly disease helped bring the index down 170 points during the session. The S&P 500 and Nasdaq Composite also posted down weeks, declining almost 1% the same day a second person was diagnosed with coronavirus in the U.S.

The flu-like virus originated in China and has led to the death of 41 people and spread to more than 1,000 others globally.

"In the end, this market wants answers and the Chinese government is not being forthcoming about how the disease is contracted or how it can be treated," said Cramer, who has warned that the epidemic could put a dent in the travel industry and associated businesses.

"Going into next week, this illness could eclipse the many earnings stories that we have coming up, because it is a big week," he said.

Cramer went on to present his game plan for the week ahead:

Monday: D.R. Horton earnings

D.R. Horton, a large homebuilder, reports earnings for its first quarter of the 2020 fiscal year before the market opens. Wall Street is looking for $3.75 billion in revenue and 92 cents per share of earnings.

Tuesday: United Technologies, 3M, HCA Healthcare, Apple, AMD, Starbucks earnings

United Technologies reports fourth-quarter and full-year results before the morning bell. FactSet estimates project $19.4 billion on the top line and $1.84 of earnings per share. Cramer is looking for an update on China and the Boeing 737 Max crisis.

"CEO Greg Hayes has a fantastic track record," he said. "Maybe we buy some United Technologies on Monday if we have a coronavirus-based sell-off."

3M's fourth-quarter report comes out in the morning. The conglomerate is estimated to post $8.1 billion on the revenue line and return $2.11 in earnings per share to shareholders.

HCA Healthcare releases its year-end numbers before trading begins and Cramer thinks it has "the best chance of reporting an upside surprise next week." The hospital chain is projected to post about $13.4 billion in revenue and $3.09 in earnings per share.

"It is a delivery machine and you have my blessing to buy it for a trade before if the market goes down on Monday," he said.

Apple, the most valuable company on the market, reports after the closing bell. The iPhone maker is expected to do $88.4 billion in sales and produce $4.54 in earnings per share, according to FactSet estimates.

"I worry that it's run ... too much. I've seen many high-flying stocks go lower on even the greatest of numbers," Cramer said.

"If management's at all circumspect [on guidance], then I do believe stock could get hit. That's why I recommend waiting if you don't already own Apple," he added.

Advanced Micro Devices also reports in the afternoon and the stock has more than doubled since the beginning of 2019. Management is expected to show $2.1 billion in revenue and 31 cents of earnings per share.

Starbucks' first quarterly report for the new fiscal year comes out after at the close. Analysts are looking for 76 cents in earnings per share on $7.1 billion in revenue.

Wednesday: Boeing, General Electric, Facebook, Microsoft earnings; Goldman Sachs analyst day

Boeing reports earnings in the morning and it will be the first shareholder call led by new CEO David Calhoun. Numbers for the embattled plane manufacturer are expected to come in at $21.7 billion in sales and 35 cents in earnings per share.

Cramer said "what I really care about is the cash flow."

General Electric also reports before the market opens. Analysts estimate revenue will come in at $25.7 billion and earnings at 17 cents per share.

"I like CEO Larry Culp very much and I believe a turnaround is happening this year, although not necessarily this quarter," Cramer said.

Facebook's fourth-quarter report will come out after the market closes. The social media company is expected to deliver $28.9 billion in revenue and post $2.52 of earnings per share.

Microsoft also releases results in the afternoon. The software giant is expected to have earnings of $1.32 per share behind $35.7 billion in sales.

Goldman Sachs is hosting an investor day starting at 8 a.m.

Thursday: Coca-Cola, Verizon, Amazon, Western Digital earnings

Coca-Cola reports in the morning and analysts are looking for the beverage titan to show nearly $8.9 billion on the revenue line and 44 cents in earnings per share.

"This is an interesting stock to buy if we see huge coronavirus-induced declines, and that's a real possibility," Cramer said. "The Chinese wouldn't be imposing this big quarantine if everything was under control."

Verizon Communications is out with its fourth-quarter report prior to the morning bell. Analysts are expecting $34.6 billion in revenue and $1.14 EPS.

"I expect Verizon to deliver again, and if it doesn't, buy some on weakness," the host said.

Amazon releases its quarterly report in the afternoon. The company is slated to post nearly $86 billion in sales and $4.05 in earnings per share for the period.

"They're in spending mode for same-day delivery and for India, and Wall Street can never seem to get its head around when they're in spending mode," Cramer said. "So, if Amazon gets hit [it's a] gift."

Western Digital's report also comes out after the closing bell. The data storage company is estimated to deliver $4.2 billion in revenue and 58 cents in earnings per share, according to FactSet.

Friday: Exxon Mobil, Chevron

Exxon Mobil reports earnings in the morning. Analysts are looking for 47 cents in profit per share on $64.3 billion in revenue.

Chevron also reports before the bell and analysts are expecting $38.4 billion in revenue and $1.45 of earnings per share.

Disclosure: Cramer's charitable trust owns shares of Amazon, Facebook, Microsoft, Goldman Sachs and Starbucks.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com