The founder of an exclusive investment club for the ultra wealthy told CNBC on Thursday that his members are sitting on piles of cash to protect against an economic downturn.

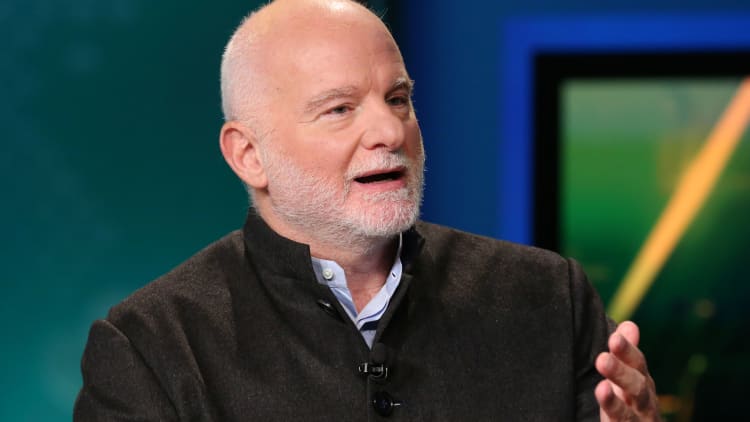

Michael Sonnenfeldt, the founder and chairman of Tiger 21, said on "Squawk on the Street" that members of his club have about 12% of their portfolios in cash.

"Members ... have protection with large amounts of cash so if there is a downturn, they can weather through it rather than having to liquidate at the wrong time," Sonnenfeldt said.

The upcoming presidential election and the widening coronavirus outbreak are two areas of concern for club members, he said.

Sonnenfeldt said that cash on hand makes it easier to jump at attractive buying opportunities.

Many high-profile money managers have urged people not to sit on cash — and instead, stay fully invested. They cite low interest rates and difficulty in timing market moves, among other reasons.

Billionaire Bridgewater Associates founder Ray Dalio told CNBC that "cash is trash," during an interview earlier this month at the World Economic Forum in Davos, Switzerland.

Sonnenfeldt that he thought Dalio's advice was not necessarily wrong but might not apply to Tiger 21 members.

"We think Ray is one of the great investors, but our community is made up of entrepreneurs," Sonnenfeldt said. "I wouldn't go toe-to-toe with Ray investing large sums of capital, billions. But with small sums of capital, our members create magic, and they do that by having the cash ready to deploy the opportunity presents itself."

In order to become a member of Tiger 21, investors must have investable assets of at least $10 million and pay an annual fee of $30,000, according to the club's website. The club has more than 700 members that collectively manage over $75 billion in assets.