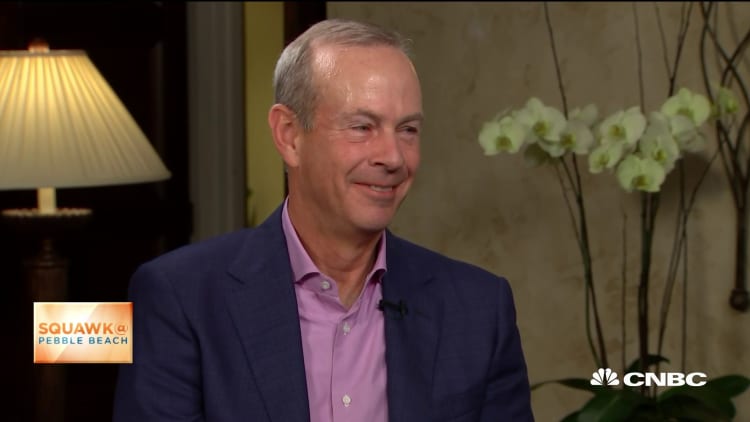

Traditional energy stocks have come under fire as the sustainable investing movement gains traction, but Chevron chairman and CEO Michael Wirth said it's unfair to compare the sector to other oft-maligned areas of the market given the role oil production has played in societal development.

"The reality is the world runs on the energy system that we have today," Wirth said Friday on CNBC's "Squawk Box" from Pebble Beach, California. "I think the comparison to tobacco is not an appropriate one at all. If tobacco use were ceased today, I think the world would be just fine. If we ceased use of all hydrocarbon products today, the world would not be fine, and I think that's the reality."

Energy was the worst-performing sector in 2019, and amid the combination of low oil prices pressuring profits and the sector falling out of favor with investors, some believe the sector's best days are behind it.

"I'm done with fossil fuels ... they're just done. We're starting to see divestment all over the world," Jim Cramer said Jan. 31 on "Squawk Box." "You're seeing divestiture by a lot of different funds ... we're in the death knell phase," he added.

But Wirth said the sector can and will recover, and that the stocks will head higher once again.

"We've been in a rough period of time. Commodity prices had a historic collapse last decade. They're still very low because we've got a well supplied market, and I think companies have had to re-size their investments accordingly," he said.

In the fourth quarter Chevron reported a $6.6 billion loss, driven by a $10.4 billion write-down related to its shale gas production, primarily in Appalachia.

The company also raised its dividend by 8% and said it's buying back shares and reducing debt. Wirth said that in 2019 the company produced more oil than at any point in its 140 year history.

Despite these initiatives, shares of Chevron have lost 7% in the last year. By comparison, the S&P 500 has gained 23%.

U.S. West Texas Intermediate crude currently trades around $50 per barrel, which is a far cry from the $100 per barrel it fetched as recently as 2014.

Amid this backdrop, Wirth said Chevron is focused on capital discipline, and that the company has sized its operations to compete across a range of oil prices.

"I think we just need to continue to deliver results quarter after quarter and I think the investment will be there," he said.

Coronavirus impact

Oil prices are heading for a fifth straight week of declines as the Street fears that the coronavirus outbreak will lead to a slowdown in the global economy, which will reduce the demand for crude.

"It's clear that demand for air traffic, marine freight in and out of china is off considerably," Wirth said, before noting that "it's still early to say how this will play out as the news about the virus continues to evolve."

In January WTI fell 15.56% for its worst monthly performance since May 2019, and prices are currently trading around one-year lows.

"We really invest for the long term, so we don't swing our activities around until we see a long-term change. We've built our company for the kind of environment we see today," Wirth said.