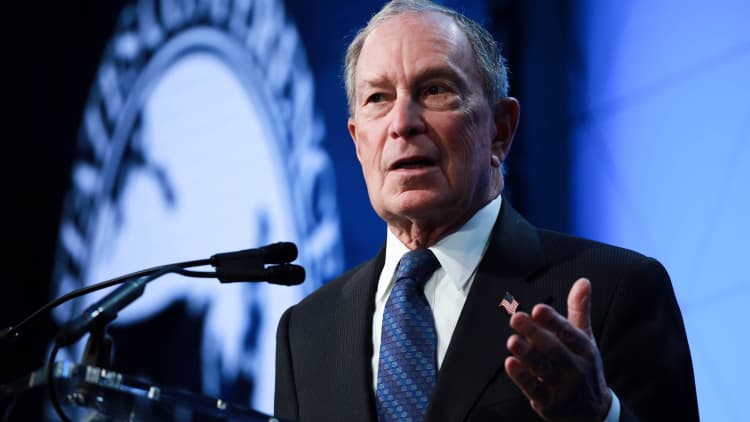

Presidential candidate Mike Bloomberg on Tuesday rolled an ambitious plan to rein in Wall Street, echoing platforms of some of his more liberal Democratic rivals.

Bloomberg's plan would bolster many of the reforms either put in place or strengthened as part of the 2010 Dodd-Frank Act in response to the Great Recession, a crisis that some blamed on Wall Street banks.

The billionaire, who made his own fortune on Wall Street, has now spent at least $400 million in advertising for his campaign, according to Kantar Media.

Bloomberg was mayor of New York from 2002 to 2013, during the financial crisis and its aftermath. During that time, he pushed back against certain proposals to tighten banking oversight, calling them "shortsighted" and contending they would "provide major advantages" to foreign competitors.

As presidential candidate, Bloomberg appears to be moving to the left of that stance. He said in a statement Tuesday, "The financial system isn't working the way it should for most Americans."

Here are the priorities in Bloomberg's Wall Street plan, according to a campaign press release:

- Strengthen reforms put in place following the Great Recession to regulate banks and protect consumers, including the Volcker Rule and Consumer Financial Protection Bureau.

- Restore funding to the Office of Financial Research that monitors bank riskiness.

- Enable the Department of Justice to put individuals in jail for "infractions."

- Introduce a 0.1% financial transaction tax.

Bloomberg said as president he would toughen the Volcker rule, which limits banks' proprietary trading, or trading stocks for their own gain. Merging mortgage giants Fannie Mae and Freddie Mac into a single entity, according to the proposal, would make the two institutions more efficient.

Bloomberg would "restore and strengthen" the Consumer Financial Protection Bureau to protect consumers," after the agency has been weakened under President Donald Trump's administration.

The call for increased oversight in some ways mirrors proposals from fellow presidential hopeful Sen. Elizabeth Warren, an advocate of the 2010 Dodd-Frank Act, who played a key roll in launching the CFPB. Warren has made financial reform a key part of her presidential platform, including a push to increase oversight of bank deals, a process she has called "fundamentally broken."

Bloomberg also echoed his more liberal challengers in promises to create a dedicated corporate crime group at the Department of Justice empowered to prosecute individuals, as well as corporations, for infractions. The topic has come under a new spotlight in the wake of recent corporate scandals like the two fatal plane crashes that occurred under former Boeing CEO Dennis Muilenburg's watch.

Candidates, including Sen. Bernie Sanders have said they believe jail time should be on the table for CEOs. Sanders previously said he would use the powers granted the government under the federal anti-monopoly law, the Sherman Antitrust Act, to prosecute executives. Lawyers, though, have debated the extent of the government's ability to do so under the act.

Bloomberg also said he would introduce a 0.1% transaction tax to "raise revenue needed to address wealth inequality." That tax comes on top of other taxes on the wealthy he has proposed as part of his $5 trillion tax plan.

Bloomberg on Tuesday qualified for his first appearance in a Democratic presidential primary debate. He will take the stage in Nevada on Wednesday after a NPR/PBS NewsHour/Marist poll showed him receiving 19% of support.

In the lead-up to his debate debut, Bloomberg also rolled out an education plan and criminal justice reform. His education plan proposes making two-year public college tuition-free for all and debt-free for the lowest-income students. His criminal justice proposal "would end era of mass incarceration" and commits $22.5 billion to reducing the prison population by 50% by 2030. Bloomberg's controversial "stop and frisk" police strategy has come under renewed spotlight amid his rise in the polls.