Technical indicators are showing that Apple may now be in the clear to buy, but the S&P 500 not so much, CNBC's Jim Cramer said Tuesday.

"The charts as interpreted by Carolyn Boroden suggest that some stocks might be safer to pick at here, like Apple, but the broader S&P 500 might not be out of the woods yet," the "Mad Money" host said. "As we saw today, yesterday's huge bounce could prove to be a tad ephemeral."

Cramer relied on Boroden's analysis to get an "empirical," non-emotional approach to a volatile Wall Street environment.

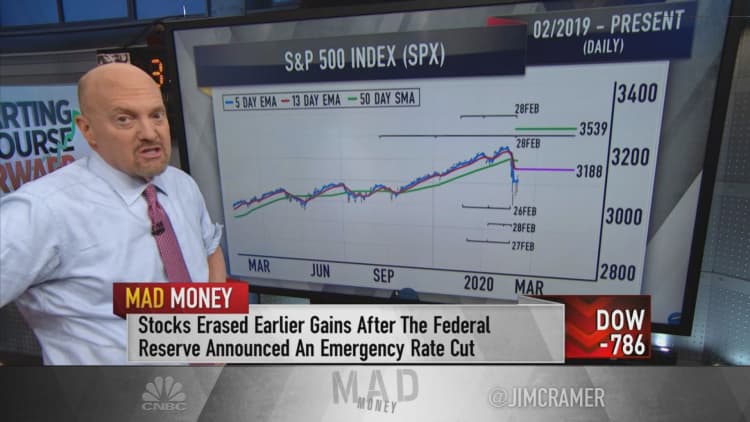

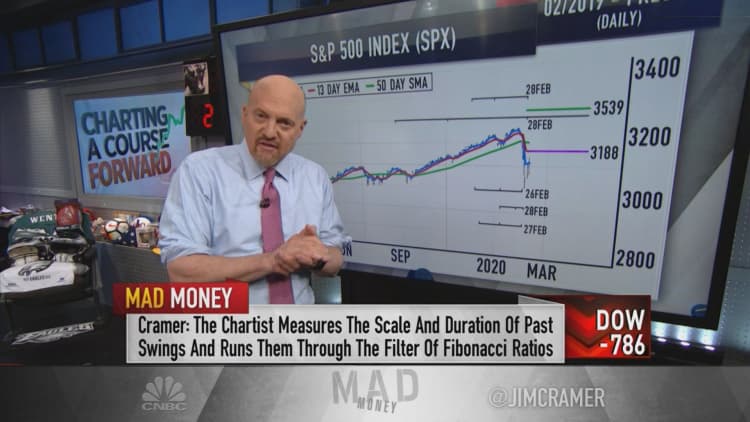

Boroden, a chart analyst who runs FibonacciQueen.com and a contributor at RealMoney.com, came to her conclusion after analyzing the moving averages in Apple stock prices and the S&P 500. The five-day exponential moving average and 13-day exponential moving average — indicators used to assess a stock's trend outside of short-term fluctuations — behind the two securities are flashing different signals, according to Boroden.

The S&P 500 managed to rally 4.6% Monday coming off a brutal week of trading, but Boroden doesn't think the index has put in a bottom, Cramer explained. That's because the five-day moving average is trailing the 13-day average, which is a trusted sell signal, he said.

"Plus, the S&P's now well below its 50-day simple moving average, and we're falling through every meaningful floor of support that we had," Cramer said. "If we end up retesting Friday's lows, Boroden's not sure they will hold."

The S&P 500 fell below 2,856 at its lowest point in Friday's session. The index closed at 3,003.37 Tuesday.

"On the other hand, if that low does hold, then the upside could be enormous," the host said, "but if you want to make a bet, Boroden says you need to be ready to bail if the trade starts going against you."

There are greater odds that shares of Apple can continue an uptrend, based on Boroden's approach. Her Fibonacci methodology, ratios used to predict price movements, found that Apple may have a floor of support at $256 per share. The stock bottomed at $256.37 on Friday and was back up to $289.17 at Tuesday's close.

The key to Boroden's more positive sentiment on Apple is that the five-day moving average is above the 13-day moving average, which is a buy trigger, Cramer said.

"Now, Apple has a ceiling of resistance at $312, but if it can clear that hurdle, she sees it going to $347," he said. "Of course, if the floor doesn't hold that or if it fails to clear that ceiling, well, you're looking at a much more bearish story."

Disclosure: Cramer's charitable trust owns shares of Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com