The market's wild swings have Todd Gordon rethinking his portfolio.

First, Gordon's firm, Ascent Wealth Partners, eliminated its position in Disney given that coronavirus fears have raised concerns about parks, resorts and other big public entertainment spaces. Parks and resorts are a significant revenue generator for Disney, so that was a main concern for Gordon as well as the uncertainty ahead for the company after the departure of former CEO Bob Iger.

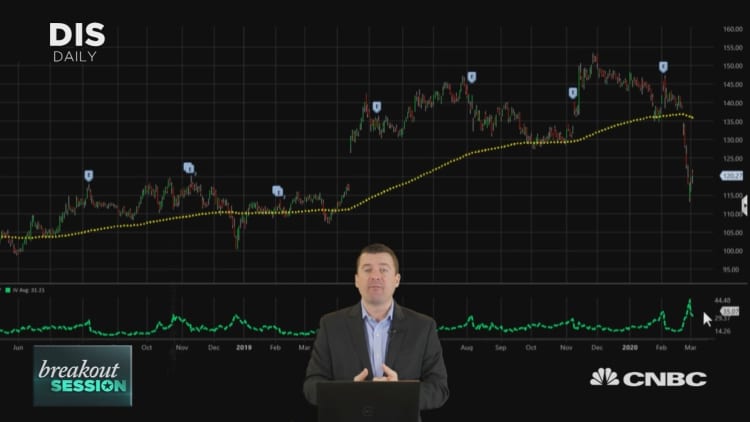

What's more, Gordon says Disney's technicals look "vulnerable" as of late. Not only has Disney broken below a support level of $135, the stock has also dropped significantly below its 200-day moving average.

On the other hand, Gordon's firm moved into the Nasdaq 100-tracking ETF (QQQ). Not only does he believe QQQ is "fairly limited" in its exposure to the coronavirus in terms of the supply chains of its companies, he thinks it will resume leadership relative to the broader market.

"It has shown good relative strength prior to the volatility," he said on CNBC's "Trading Nation" on Tuesday. "Theory should have it that you'd expect the leader in the past to resume its leadership should the volatility settle out."

Gordon is currently eyeing the QQQ's 200-day moving average, which is around $200 based on how it has served as a support level most of the time for the ETF. He recommends a put sale given the current high volatility.

Since the start of the year, Disney has fallen 22%, while the QQQ is back to near its levels at the start of 2020.