The rapidly spreading coronavirus is weighing heavy on the stock market, despite what the underlying fundamentals of companies are telling investors, CNBC's Jim Cramer said Friday.

The number of cases outside of China, where the novel disease is believed to have originated in the Hubei province, are growing exponentially and Wall Street players are concerned about how it could impact world commerce. That contributed to another week of chaotic trading days.

"We just got through a rollercoaster of a week marked by the emergence of some terrifying sector bear markets," including oil and gas, travel and leisure, retail and the financials, the "Mad Money" host said.

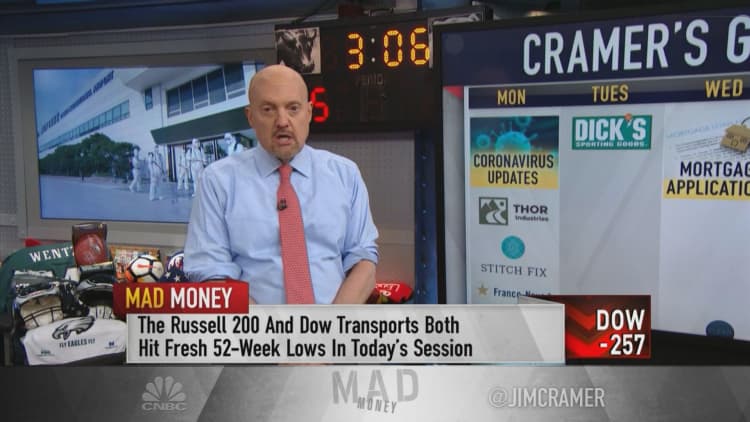

The Dow Jones Industrial Average plunged almost 900 points in Friday's session, though the 30-stock index finished down about 257 points, or roughly 1%, to close at 25,864.78. The S&P 500 and Nasdaq Composite swung more than 4% to their lows of the day before closing down less than 2%.

The major indexes all finished the trading week in the green, however.

"Pay attention to what these companies have to say next week, but don't forget that — at least for the moment — COVID-19 is in the driver's seat," Cramer said.

Cramer went on to present his game plan for the week ahead. All earnings estimates are based on FactSet estimates.

Monday: Thor Industries, Stitch Fix, Franco-Nevada earnings

Thor Industries reports earnings for its fiscal 2020 second quarter before the opening bell.

- Projected revenue: $1.82 billion

- Projected earnings per share (EPS): 72 cents

"Thor's the biggest maker of recreational vehicles around and I'm betting they're going to give us a lot of insight into the state of the consumer," Cramer said. "Their inventories, they tend to balloon when people are scared to death."

Stitch Fix reports fiscal 2020 second-quarter earnings after the closing bell.

- Projected revenue: $452.6 million

- Projected EPS: 7 cents

"This company has an impressive track record of profitability with a stock that's now down 11% this year," Cramer said. "I suspect the Stitch Fix model is ideal for this environment, but we'll see."

Franco-Nevada reports fourth-quarter earnings after the closing bell.

- Projected revenue: $316 million

- Projected EPS: 66 cents

"You know, I think gold's the perfectly positioned commodity because it's a safe-haven in times of economic chaos," the host said.

Tuesday: Dick's Sporting Goods

- Projected revenue: $2.56 billion

- Projected EPS: $1.22

"Last time, it delivered a monster good number," Cramer said. "Remember, the outbreak won't be included in these results, but management here is so transparent that I bet they'll give us a look and feel for the past few weeks."

Thursday: Dollar General, Ulta Beauty, Broadcom, Adobe, Gap earnings

Dollar General reports fourth-quarter earnings in the morning.

- Projected revenue: $7.15 billion

- Projected EPS: $2.01

"This discount retailer's made fortunes for its shareholders and I bet it shines, even in an all-coronavirus world," Cramer said.

Ulta Beauty reports fourth-quarter earnings after the closing bell.

- Projected revenue: $2.3 billion

- Projected EPS: $3.73

"I think people buying Ulta here seem to believe it's recession-proof, but I'd say it's recession-resistant," the host said. "I'm concerned about anything retail here, though, especially if it has a hair salon component."

Broadcom reports fiscal 2020 first-quarter earnings after the closing bell.

- Projected revenue: $6 billion

- Projected EPS: $5.34

Adobe reports fiscal 2020 first-quarter earnings after the closing bell.

- Projected revenue: $3 billion

- Projected EPS: $2.23

"As for Adobe, it has the ability to allow some separation between tech and everything else," Cramer said. "If they see a slowdown, then Friday's going to be nasty."

Gap reports fourth-quarter earnings after the closing bell.

- Projected revenue: $4.54 billion

- Projected EPS: 41 cents

Disclosure: Cramer's charitable trust owns shares of Broadcom.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com