Getting private lab testing for the new coronavirus may become more widely available now that the Centers for Disease Control and Prevention has expanded its testing guidelines for COVID-19.

Lab Corp. announced last Thursday it was immediately offering testing for COVID-19, while Quest Diagnostics said it will start testing specimens this week. The CDC said on Monday that testing was now available in all 50 states, with a total of 75,000 lab kits "cumulatively" for public labs and more coming on board soon, according to comments on a conference call made by Dr. Nancy Messonnier, director of the CDC's National Center for Immunization and Respiratory Diseases. A majority of coronavirus testing will likely come from the private sector, she said, adding that private labs have more testing kits.

Still, many Americans who want to be tested and may need treatment may be wondering who will pay for the cost.

The Trump administration has designated the new COVID-19 test as an essential health benefit, saying Medicaid and Medicare plans would cover the cost of the screening.

A few states, including New York and Washington, have issued emergency orders directing state-regulated health insurers to waive any copayments or deductibles for patients who need tests for the coronavirus.

Health insurer Cigna will waive co-pays or cost-shares for COVID-19 testing on many plans. Aetna, which is owned by CVS Health, also said it will waive co-pays for "all diagnostic testing related to COVID-19" and that meets CDC guidelines. UnitedHealthGroup said it will waive member cost sharing, including copays, coinsurance and deductibles for COVID-19 diagnostic testing provided at approved locations in accordance with CDC guidelines for all commercial insured, Medicaid and Medicare members.

As of March 6, many additional health insurance companies had announced actions related to COVID-19.

However, there are differences in what costs may be incurred by patients depending on the type of their plan, its coverage and insurance carrier. Insurers such as UnitedHealthcare said they will also work to work with self-insured plans — many large and mid-size U.S. employers are self-insured, which means they use insurance companies to administer their plans, but pay the costs themselves and can set benefits and cost-sharing terms.

"Understanding what your benefits are regardless of what your friend or family member's benefits may be with the same health insurance company is very important," said Anthony Lopez, senior director eHealth, an online health insurance marketplace. "Your friend may have a $20 co-pay and your doctor visits may be a $10 co-pay, so understanding your own benefits is very important."

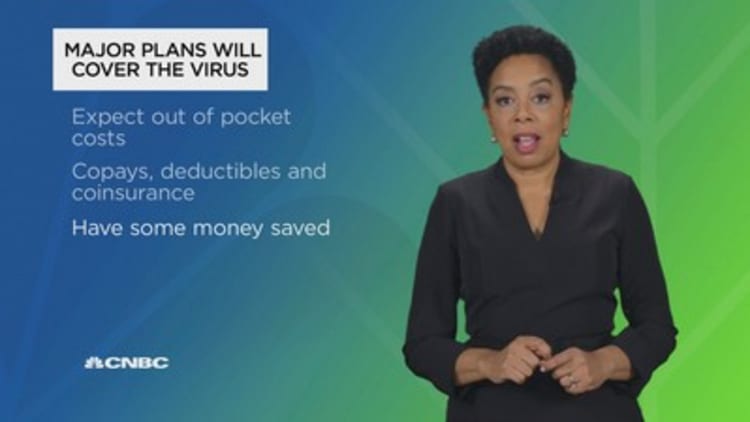

The good news is all major health plans should cover this new virus just like they would the flu, pneumonia or any other illness, said Lopez, who is a former health insurance agent. Yet the reality is that means many consumers will still have to carry some of the costs.

Here are expenses to consider:

Copays and cost-sharing may be waived in some cases for COVID-19 testing, but not necessarily for all tests, treatments, office visits or other medical care related to your illness.

Before your medical coverage kicks in, depending on your plan, you may have to face copays, coinsurance — and your deductible. The average deductible amount for single coverage was $1,655 in 2019, according to the Kaiser Family Foundation. More than a quarter of workers who were covered by an employer's plan paid a deductible of $2,000 or more last year.

Lopez says if you're hospitalized or quarantined at a medical facility, it should be covered like any other inpatient stay. And if you're self-quarantined at home, your plan should cover any doctors visits if you go out and medical care by a licensed professional if you stay in. However, if you're looking into experimental or alternative treatments, that will likely not be covered if it's not considered standard care.

Your portion of all these costs can add up quickly, so it's a good idea to have some money saved.

"People always need to make sure they can afford their deductible, but sadly many can't," said physician and financial advisor Carolyn McClanahan, founder of Life Planning Partners. A 2019 Bankrate survey found only 40% Americans said they would pay an unexpected $1,000 expense, such as an emergency room visit, with savings. More than a third would need to borrow the money in some way, either with a credit card, personal loan or from family or friends.

Since plan coverage can vary even with the same insurer, find out what potential costs you may face ahead of time. Call the number on the back of your insurance card to reach your insurance carrier and review your specific benefits.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: 'The only type of travel insurance' you need if you're traveling during the coronavirus outbreak via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.