Treasury Secretary Steven Mnuchin told CNBC on Monday there will be a surge of demand for stocks once the coronavirus threat abates.

"There will be a huge amount of pent-up demand when this is done. And it will be done," the Treasury secretary told CNBC's Jim Cramer.

"Look for companies that have a ton of liquidity. An Apple will have customers," Mnuchin added. "That's just a given. The goal is not to bail out companies."

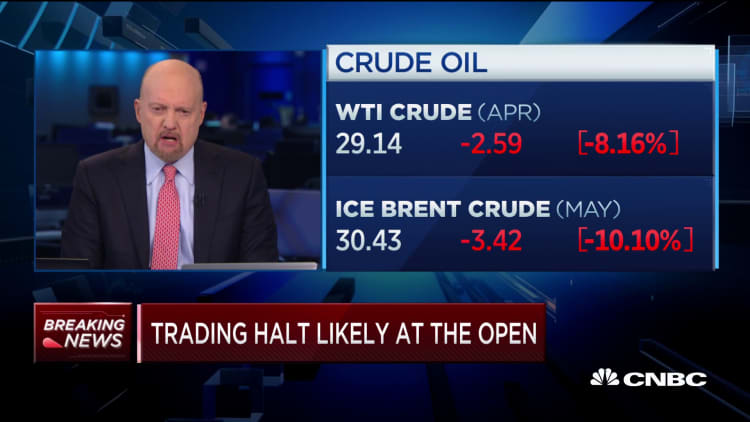

His comments, which Cramer read on the air, came minutes before another swoon on Wall Street. The major indexes fell more than 10% within the first minutes of trading, triggering a Level 1 circuit breaker that halted trading for 15 minutes. Before Monday's moves, the Dow and the S&P 500 were down more than 20% from their respective intraday records hit in February.

Mnuchin also told Cramer he believes the nation's largest banks will be able to handle this market downturn, unlike how they fared during the 2008 financial crisis.

"The banking system can handle this after the Fed's actions. Now it is a question of liquidity for those who need it... To keep entities from closing ... and help the working person," he said. "Our stimulus is designed to let small businesses keep people on payroll. ... We'll always be thinking about what happens after we get through this."

He also lauded the Federal Reserve and its decisive action on Sunday to cut U.S. interest rates to zero.

"The Fed is ahead of the issues and I'm grateful; nobody has to pull money out of the banks," he said. "Liquidity for small businesses is chief priority. ... Restaurant and bar owners, for example — we're trying to get money to them to tide them over."

The Fed on Sunday cut interest rates down to basically zero and launched a massive $700 billion quantitative easing program. President Donald Trump said he was "very happy" with the announcement, adding: "I think that people in the markets should be very thrilled."

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.