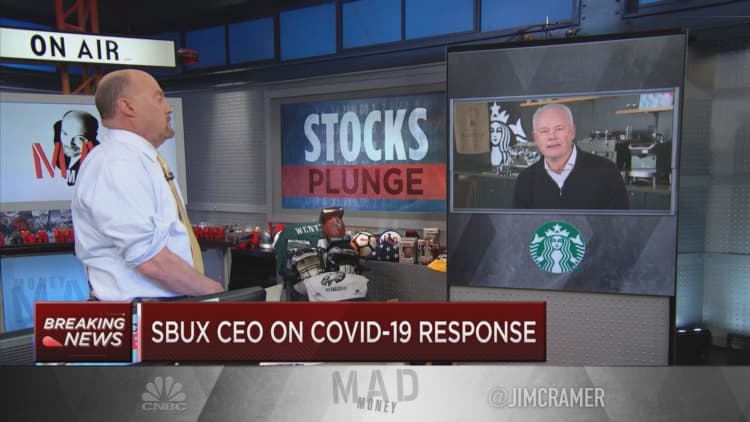

Starbucks CEO Kevin Johnson on Wednesday defended the company's share buyback program as the coronavirus pandemic roils the restaurant industry.

"We're being thoughtful and responsible," Johnson said in a interview with Jim Cramer on CNBC's "Mad Money." "Look, we've got a strong balance sheet, BBB investment credit rating. If you look at our last earnings call, we had $3 billion of cash on the balance sheet; we've got a $3 billion line of revolving credit."

The global coffee chain announced on Wednesday that its board had authorized the repurchase of up to 40 million shares through the end of fiscal 2021. An existing authorization allows Starbucks to repurchase an additional 16 million shares. Johnson said the approval is "nothing above and beyond" its usual share buyback program.

The National Restaurant Association, a lobbying group for the industry, has asked the federal government for financial assistance, including a $145 billion recovery fund for restaurants. The airline industry, which is seeking more than $50 billion in assistance, is facing scrutiny from Democrats for the billions of dollars it has spent on buybacks in the last five years.

Like other restaurant companies, Starbucks is grappling with the impact of the coronavirus pandemic. The chain is reopening cafes in China after temporarily closing more than half of them in response to the virus. Starbucks expects a revenue hit of $400 million to $430 million in the fiscal second quarter due to the Chinese closures. In the United States, the Seattle-based chain has paused the use of seating.

"We've modeled every scenario that we think could happen, even extreme scenarios, and we're going to be just fine," Johnson said.

Shares of Starbucks closed Wednesday down 4.5%. The stock, which has a market value of $66.1 billion, has fallen nearly 36% so far in 2020.

Disclosure: Cramer's charitable trust owns shares of Starbucks.