CNBC's Jim Cramer has spent recent weeks outlining publicly traded companies that are performing well, moderately well and poorly since the onset of the coronavirus outbreak.

On Wednesday, the "Mad Money" host revealed a new faction within the stock market: laggards that are waiting to break out.

"Right now, we've also got a fourth category: companies that are currently stinking up the joint, but should thrive when things get back to normal," he said.

Some of the titans in tech are included in Cramer's new bunch. The corporations that are struggling now but that he expects to return to form are Apple and Facebook.

China, ground zero of what has now become a global health pandemic, was the first country and economy to be hit by the virus. Businesses operations there, where many American enterprises such as Apple assemble products, were either forced shut or lost productivity as the Hubei province, the epicenter of the coronavirus outbreak in China, was shut down in late January. Apple also decided to close its store outside of Greater China for much of the month of March to help combat the virus's spread.

Two months later, Chinese authorities say restrictions will be lifted on the Hubei capital of Wuhan next month. Meanwhile, American companies such as Starbucks and Hormel have restored their China operations.

On Tuesday night, Deutsche Bank upgraded stock in the iPhone maker to a "buy" from "hold." Apple stock is down nearly $82 from its Feb. 12 close.

"China's coming back online, and sooner or later the same thing is going to happen in Europe and the United States," Cramer said, adding that he expects "Apple to come back stronger than before."

As for Facebook, the social media giant warned earlier in the day that its advertising business is taking a hit due to the fast-spreading virus, despite an increase in traffic on its platforms.

Facebook shares are down $67 from its record high close Jan. 29. At $156.21 per share, it's up 14% from its lowest trade during the outbreak.

"It's not as strong as Apple, but it might be worth owning if the stock gets driven low enough," Cramer said. "Turns out, Facebook's a lot more cyclical than most people thought because, at the end of the day, it's advertising, and the ad industry is cyclical."

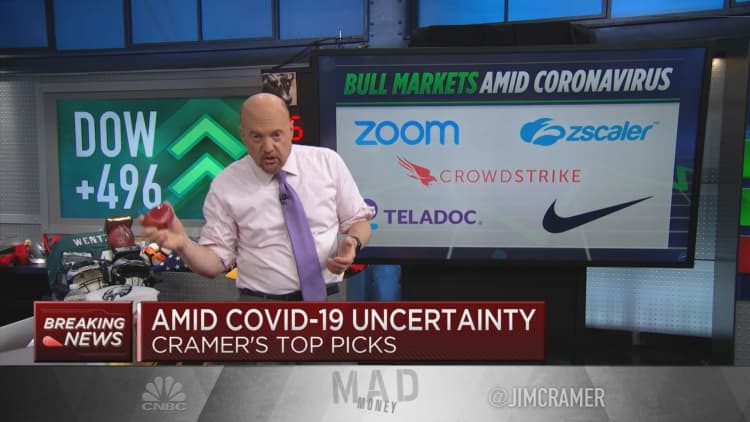

Among Cramer's winners are Zoom Video, Zscaler, Crowdstrike, Teladoc Health and Nike. He identified Johnson & Johnson as among the drug and consumer staple stocks that are "slow-and-steady" growers.

The cruise lines, he added, are in extreme danger, even with government aid to keep the companies above water. Their ships were an initial focal point of the epidemic as multiple vessels and passengers were forced into quarantine after riders tested positive for COVID-19.

Shares in both Royal Caribbean and Norwegian Cruise Line shot up 23% in Wednesday's session.

"The cruise lines can't recover until people stop being scared. That won't happen until we beat this thing and then people put it out their memory," Cramer said. "That's the opposite of Zoom, so if you still own any cruise stocks ... you've got to use this strength to get out of them, even if the government does its best to save them."

Disclosure: Cramer's charitable trust owns shares of Facebook, Apple and Johnson & Johnson.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com