Oil prices registered their worst quarterly performance on record over the first three months of the year, as the coronavirus pandemic continues to crush global demand for crude.

Brent futures dipped 0.09% lower on the final trading day of the first quarter, settling at $22.74, while WTI gained almost 2% to settle at $20.48 in the previous session.

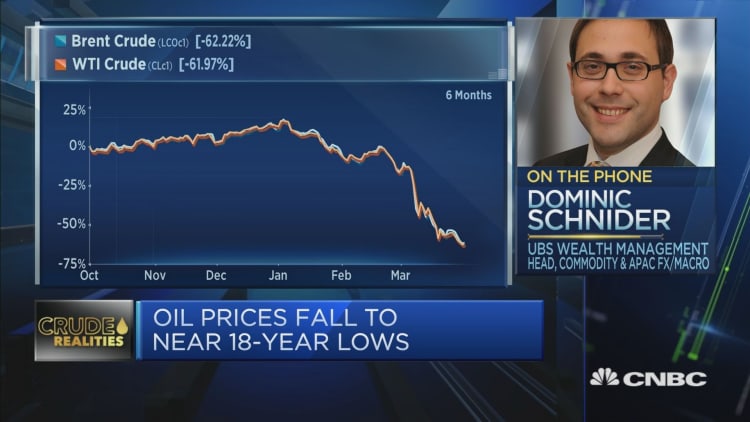

It means Brent futures have collapsed more than 65% over the first three months of the year, registering their worst-ever quarter through our history to 1990, according to data compiled by CNBC. Brent also recorded its worst-ever monthly performance in March, falling over 54%.

Meanwhile, WTI futures slumped more than 66% in the first quarter, recording their worst-ever quarterly performance back to when the contract began trading in 1983. WTI futures fell over 54% last month, registering its worst-ever monthly performance, too.

A public health crisis has meant countries around the world have effectively had to shut down, with many governments imposing draconian measures on the daily lives of hundreds of millions of people.

The restrictions have created an unprecedented demand shock in energy markets, ramping up the pressure on companies and governments reliant on crude sales.

To date, more than 860,000 people have contracted COVID-19 worldwide, with 42,345 deaths, according to data compiled by Johns Hopkins University.

International benchmark Brent crude traded at $25.34 a barrel Wednesday morning, down more than 3.8%, while U.S. West Texas Intermediate (WTI) stood at $20.18, more than 1.4% lower.

Storage capacity likely to 'hit its limit by midyear'

Oil consumption has collapsed by at least 25% compared to 2019 levels of 100 million barrels per day (b/d), according to analysts at Eurasia Group, with severe restrictions on global movement and most retail in lockdown.

"With demand collapsing but supply rising after OPEC and non-affiliated Russia failed to reach a production cut agreement in early March, global inventories could reach their maximum capacity within weeks," Eurasia Group analysts said in a research note published Monday.

"Even if OPEC and other producers start restricting their output again soon, the supply overhang from the global lockdown is so big that storage capacity will likely hit its limit by midyear," they added.

Last month, oil producer group OPEC and its allied partners, sometimes referred to as OPEC+, failed to agree on extending production cuts beyond March 31.

It has led to concerns of a supply surge from April 1, with Saudi Arabia and the United Arab Emirates both pledging to ramp up production.

Industry experts have warned that plans to ramp up production could prompt a wave of bankruptcies and investment cuts in the U.S. which, in turn, would have a noticeable impact on shale production.

On Monday, U.S. President Donald Trump and Russian President Vladimir Putin held talks to discuss Moscow's ongoing oil price war with OPEC kingpin Saudi Arabia.

The Kremlin said Trump and Putin had agreed to have their top energy officials discuss stabilizing oil markets.

Trump had initially welcomed the declaration of a price war between Saudi Arabia and Russia, hailing lower oil prices as good news for U.S. consumers.