The Treasury Department is sending a message to large companies weighing government aid to weather the coronavirus pandemic: No free rides.

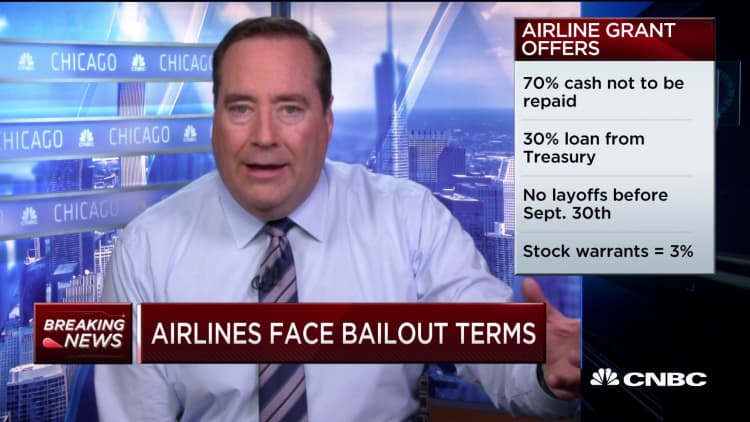

Negotiations between airlines and the department over payroll grants have dragged on longer than expected after the Treasury Department requested more information and proposed additional conditions for the aid, a hint of what companies could face as they seek government assistance to blunt the impact of the virus and harsh measures like shelter-in-place orders aimed at slowing its spread.

U.S. passenger airline executives cheered when Congress passed a $2 trillion coronavirus relief package that included $25 billion in airline payroll grants on the condition that they they don't furlough or cut the pay rates of their employees through Sept. 30, as carriers face the deepest crisis in their history.

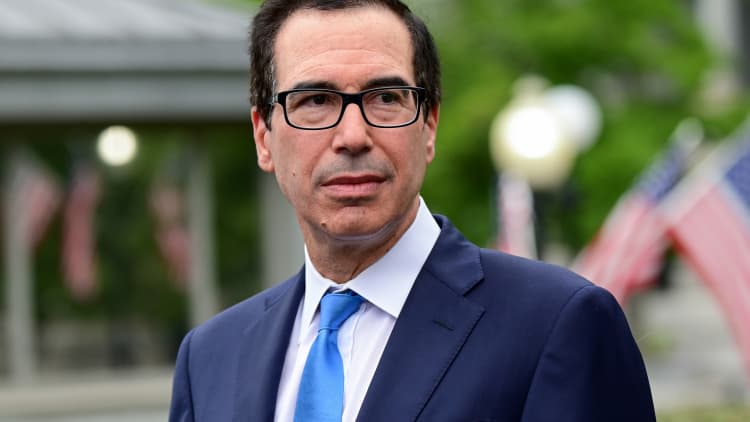

But Steven Mnuchin's Treasury Department has asked the country's largest airlines to pay back 30% of the grants for which they applied, essentially turning them into low-interest loans, according to people familiar with the matter. The grants would also come with equity warrants for 10% of the value of the loan. Talks continued over the weekend and airlines are closing in on deals, which could be announced early this week, according people familiar with the discussions.

Labor unions, some lawmakers and industry members have balked at additional conditions on the payroll grants, arguing they go against what was outlined in the aid package, that they could be too onerous for airlines to either accept or that they could leave carriers on shakier footing later on.

"Direct Payroll Assistance funding in the form of grants only is considerably more effective for our employees rather than a hybrid combination of instruments," said Airlines for America, a trade group that represents the country's biggest airlines, including Delta, United, American, Southwest and others. "This federal relief is critical to getting our employees paid and preventing furloughs right now, especially as our country is experiencing historically high unemployment claims."

But Treasury Department isn't expected to cede much ground, according to people familiar with the talks. Treasury officials, which are working with financial advisers and lawyers on the aid, believe the $2 trillion relief package, known as the CARES Act, gives the department wide discretion to implement the airline grants, including converting some of them to loans, a person familiar with the situation said.

Sens. Edward Markey (D-Mass.) and Richard Blumenthal (D-Conn.) on Monday wrote to Mnuchin and Transportation Secretary Elaine Chao that "even if airlines accept relief funding with these conditions, each company's ability to preserve its workforce will be imperiled when the Treasury Department later demands repayment, leaving employees to ultimately pay the price."

Mnuchin's requests in these rounds of negotiations may have broader implications as executives and taxpayers look for signs on how the Treasury approaches the $500 billion in loans, guarantees or other aid that Mnuchin is overseeing for businesses and states.

Mnuchin has repeatedly said the taxpayers need to be compensated for the aid, payments that may also come in the form of stock warrants or other securities, according to guidelines released by the government.

"It is our objective to make sure, as I have said, that this is not a bailout, but to make sure that airlines have the liquidity to keep their workers in place," he said last week.

"This isn't what we agreed to," one airline industry source said of the deal.

Mnuchin's conditions on the grants may set the tone for how other talks may play out as companies weigh the pros and cons of government aid, and how those conditions may affect them in an uncertain recovery.

Criticism over U.S. bailouts of banks and automakers in the financial crisis is echoing in the pandemic aid debate.

"I think Treasury seems to be responding strongly to the negative perceptions of government stimulus during the last financial crisis and they're redoubling their efforts to make sure federal money is spent responsibly," said Alex Ginsberg, a partner at Pillsbury Winthrop Shaw Pittman who works on government contract law and is advising some nonairline businesses on how to navigate the government coronavirus aid.

The Treasury Department on Friday said that it would not require applicants seeking $100 million or less to provide compensation. The first funds were supposed to be disbursed a almost a week ago, according to the aid package Congress approved last month. The department on Friday said it would provide guidance to large passenger airlines "should total requests for payroll support exceed the maximum amounts awardable under the CARES Act."

The talks come as the 2020 presidential election unfolds during the national health and economic crisis.

"I would not undersell, especially in an election year the raw feelings associated with the bailouts that have come from TARP," said David Leblang, a professor of politics and public policy at the University of Virginia, referring to the Troubled Asset Relief Program during the financial crisis. "The optics are horrible if there are no strings attached."

Leblang added that what Congress approves and how it plays out in reality can be quite different.

"Once bills hit the bureaucracy there's all kinds of interpretations," he said.

An earlier proposal for the massive coronavirus relief bill that was negotiated by Senate Republicans and Mnuchin offered only loans to airlines.

Lawmakers on both sides of the aisle have acknowledged the critical role airlines play in transportation and employment in the U.S.

Carriers employ some 750,000 but demand has dropped at the fastest clip on record, forcing airlines to take extreme cost-cutting measures that include urging employees to take unpaid leave, parking hundreds of jets, deferring new orders, and slashing service, in some cases by more than 90% or cutting destinations altogether. Delta CEO Ed Bastian last week, for example, said the Atlanta-based airline hasn't had so little service to New York City since the 1980s.

"The sharp reduction in customers means that we're currently down to about 5 percent of the passengers that we normally see this time of year," Bastian wrote in an employee memo last week. "No one knows exactly what the future will bring, but preserving our cash will be critical to getting us through the second half of the year."

Some airline executives have warned their employees that despite the aid, they might emerge from the crisis as smaller carriers because the coronavirus has had such a devastating impact on demand as the fewest Americans in decades choose to fly.