Norway's Equinor announced Thursday it will cut its quarterly dividend payment to shareholders by two-thirds, potentially paving the way for other oil majors to follow suit over the coming days.

The state-controlled oil company said its first-quarter cash pay-out to shareholders would be $0.09 per share, down from $0.27 in the final three months of 2019. That reflects a quarter-on-quarter reduction of 67%.

The move makes Western Europe's biggest crude producer the first oil major to cut its dividend this earnings season.

"It seems there is a chance that other majors will follow suit," Tamas Varga, senior analyst at PVM Oil Associates, told CNBC via email on Thursday.

"Clearly, suspending share buybacks and cutting capex (capital expenditure) does not do the trick anymore. In these turbulent times cash is king and the battle for remaining financially sound intensifies," Varga said.

Anglo-Dutch energy giant Royal Dutch Shell is scheduled to announce earnings on April 30, with U.S. majors Chevron and Exxon Mobil both set to report their latest quarterly figures on May 1.

France's Total is expected to announce whether they plan to cut dividends on May 5.

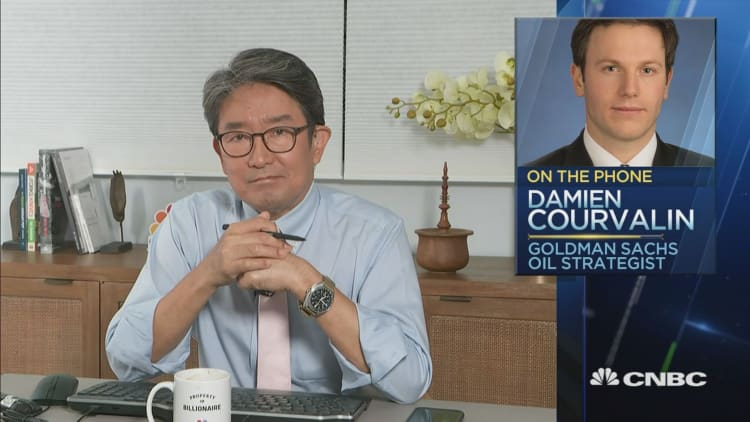

Nick Coleman, senior editor of oil news at S&P Global Platts, told CNBC via telephone that Equinor's announcement "certainly brings into focus the kind of pressures that the industry is under."

But, it should not be viewed through "quite the same lens" as the genuine global majors. He argued that while Equinor has ambitions to expand its international scale beyond Europe, it was not yet quite in the same category as Shell, BP or Total.

Coleman also said he did not believe shareholders would have anticipated the scale of the dividend cut announced on Thursday.

Shares of Equinor traded almost 1% lower during mid-morning deals.

Unprecedented market conditions

It comes shortly after a historic oil price plunge earlier this week. The May contract of U.S. West Texas Intermediate plunged below zero to trade in negative territory for the first time in history on Monday.

Trading volume was thin given it was the day before the contract's expiration date, but the move lower was unprecedented nonetheless.

To be sure, WTI futures fetched more than $60 a barrel at the start of the year. A dramatic fall-off in demand as a result of the coronavirus outbreak has sent oil prices tumbling.

On Thursday, the June contract for WTI traded at $15.72, up nearly 14%, while international benchmark Brent crude stood at $22.20, around 9% higher.

Norway's Equinor said on Thursday that the company had recently launched several actions to "increase financial resilience" in response to unprecedented market conditions and uncertainties.

Among them, it listed: A suspension of buybacks under the share buyback program; the launch of a $3 billion action plan in 2020 to strengthen financial resilience from capital expenditures, operating costs and exploration expense reductions; and a bond issuance of $5 billion.

A share buyback is when a company purchases its own outstanding shares to reduce the amount available on the open market.

"The purpose of the combined efforts, including a reduction in dividend, is to secure balance sheet capacity, strengthen liquidity and support continued investments in a high-quality project portfolio," the company said in a statement.

Correction: This article has been updated to show Total is scheduled to report first-quarter earnings on May 5.