Boeing on Wednesday posted a $641 million loss in the first quarter and is planning to cut its workforce and aircraft production in a world aviation market "frozen" by the coronavirus pandemic.

The coronavirus crisis is a fresh problem for the aircraft-maker, already struggling from the 13-month-long grounding of its best-selling plane, the 737 Max.

Here's how the company did in the first quarter:

- EPS: A loss of $1.70

- Revenue: $16.91 billion

Boeing said it plans to cut payroll by about 10% through voluntary measures and "involuntary layoffs as necessary." Boeing had about 160,000 employees at the end of last year.

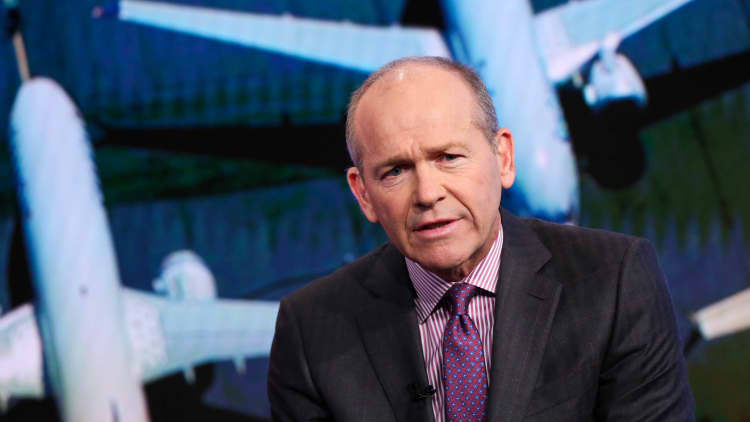

"We'll have to make even deeper reductions in areas that are most exposed to the condition of our commercial customers — more than 15% across our commercial airplanes and services businesses, as well as our corporate functions," CEO Dave Calhoun said in a staff memo. Calhoun later told reporters "higher percentages [of cuts] will be from the white collar world."

Revenue plunged 26% from a year earlier to $16.91 billion and the company posted an adjusted per-share loss of $1.70. A year ago, it posted a $2.15 billion-profit. Wall Street expected the aircraft manufacturer to post a per-share loss of $1.61 and revenue of $17.30 billion, according to Refinitiv estimates. The company burned through $4.7 billion in cash during the quarter as it grappled with rising cancellations and a dearth of orders.

Calhoun told CNBC the world's aviation market is "frozen" because of the virus and that "the industry is not interested in taking delivery of aircraft at the moment." Calhoun added that it appeared "the thaw is beginning," but he did not elaborate.

Boeing in the past few weeks already largely outlined its challenges, such as an increase in cancellations of new planes. Shares gained nearly 6% Wednesday.

With air travel in the U.S. down 95% from a year ago, Calhoun told shareholders on Monday it likely would take two or three years for travel demand to recover to 2019 levels, a sharp turnaround for an industry that just earlier this year was betting on continued growth.

"The pandemic is also delivering a body blow to our business — affecting airline customer demand, production continuity and supply chain stability," Calhoun said in the staff memo, adding that demand for "commercial airline travel has fallen off a cliff."

Boeing was already grappling with the fallout of two crashes of its 737 Max that killed 346 people. The planes are still grounded more than a year after they were ordered out of the skies by federal regulators. Boeing is still working on a fix. Meanwhile, cancellations of orders for the planes have piled up.

Boeing said it is planning to reduce aircraft production, including lowering the output of 787 Dreamliners to 10 a month from 14 this year and later to seven a month by 2022. The reductions reflect a weak market for wide-body aircraft used for international travel.

The said it plans to bring back production of the 737 Max slowly with estimated output of 31 a month next year, around half the rate it had targeted before the crashes. Some customers, including Southwest Airlines are planning to defer orders of the planes.

Boeing has recently drawn down on a nearly $14 billion loan and sought $60 billion in government aid for itself and its supply chain, which includes General Electric and Spirit Aerosystems, but Calhoun has balked at the possibility of providing the government an equity stake in return for federal aid. The company ended the quarter with $15.5 billion in cash.

Boeing also scrapped a $4.2 billion deal to take over the commercial aircraft unit of Embraer. The Brazilian manufacturer said Boeing "wrongfully" terminated the purchase agreement.

Speaking to CNBC on Wednesday, Calhoun declined to say whether Boeing plans to accept government aid, adding that "all options" are still on the table to raise liquidity. Boeing has recently offered employee buyouts, froze hiring and suspended its dividend. Calhoun is forgoing his salary this year and declined to tell reporters whether he would continue to do so in 2021.

GE also reported first-quarter earnings on Wednesday, saying revenue declined 8%. The company is doubly exposed to the slump in aviation: It produces engines for Boeing and its European rival Airbus and is one of the world's largest aircraft lessors.