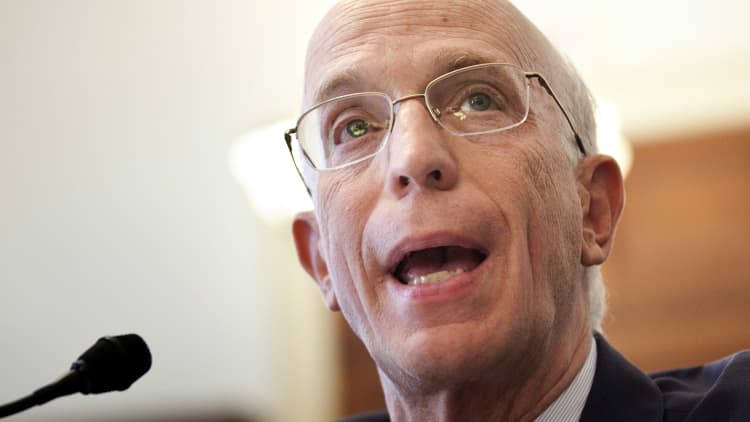

Burgeoning levels of government debt are not posing a broader threat and have been necessary to battle the coronavirus pandemic, New York Fed President John Williams said Thursday.

Even with the federal IOU at $25.6 trillion and counting, the central bank official said there's still plenty of room to spend more.

"I don't think we're anywhere near the limit to that," Williams said during a webinar presented by Stony Brook University in Long Island. "The U.S. government is issuing a lot of debt right now, and global investors are gobbling it up."

Total government debt has jumped $2.2 trillion since just before the crisis began, an increase of 9.4%, thanks in good part to the CARES Act that provides more than $2 trillion in rescue funds for an economy that could contract more than 40% in the second quarter.

Congress has been debating additional stimulus that could run to $3 trillion as states begin a tentative reopening of their shuttered economies.

The U.S. already had been on its way to a budget deficit in excess of $1 trillion that now likely will be closer to $3 trillion, according to recent Congressional Budget Office estimates.

All of that has resulted in $310.5 billion in interest payments in fiscal 2020, a total held in relative check by record-low interest rates for government debt as the Fed has sent its benchmark borrowing rate to near zero. While central bank officials have expressed a commitment to keep rates low for an extended period of time, Williams said he doesn't see the need for negative rates.

He added that he does not see the trillions in lending and liquidity programs that the Fed has initiated will lead to troublesome inflation.

"I don't see any problems right now in terms of deficits," Williams said. "Obviously, in the long run we have to make sure that the fiscal policy in the federal government is on a sustainable path."

He added that he's more concerned now with making sure money gets to the right places, particularly the state and local governments that had to lay off workers during the financial crisis.