After witnessing a brutal sell-off on Wall Street Wednesday, CNBC's Jim Cramer is still advising investors to trim their positions and wait for more attractive prices before putting more money into the market.

"The Awaken America trade has taken a turn for the worse," he said.

As coronavirus infections resurge in parts of the country, the reopen trade, or post-pandemic stocks, is backtracking and the stay-at-home plays are also in a precarious position with the market posting strong rallies month.

The major averages all plummeted more than 2% in Wednesday's session.

"I want you to raise a little cash so you can put it to work buying stocks at lower levels," the "Mad Money" host said.

"Right now the homework on some of these stocks being bought crazily by retail investors shows suboptimal fundamentals, if any fundamentals at all," he continued. "As for the tax man: the only time you don't need to pay the taxes is when you have no profits. Paying capital gains [tax is a] high-quality problem, especially with the low rates."

The Dow Jones plunged more than 710 points, or 2.72%, to 25,445.94 for its biggest percentage change in nearly two weeks. The S&P 500 shed 2.59% of value to close at 3,050.33 and the Nasdaq Composite, which has set 10 closing records this month, pulled back 2.19% to 9,909.17.

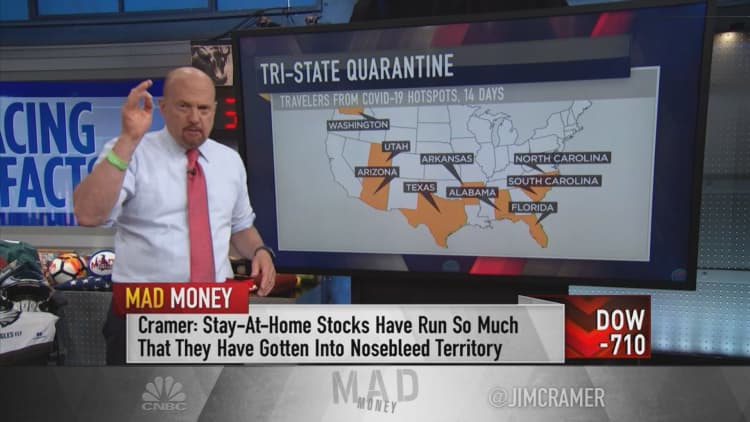

The market was digesting the spike in Covid-19 cases in dozens of states, including Florida, California and Texas, and was weighing Joe Biden's improving odds of winning the White House this fall.

"The Nasdaq just had its biggest rally since the fourth quarter of 1999, the last full quarter before the dotcom bubble burst," Cramer said. While "the prices we saw back then in '99 were absurd given the lack of earnings, or even sales, at some of these companies. Today, tech, which is the leader, is very different."

The biggest names in tech, who pull in large profits, are poised to "right themselves" after rallying hard in recent days, Cramer said. Those stocks include Alphabet, Amazon, Apple, Facebook and Microsoft whose year-to-date gains range from about 7% to as high as 48%.

Cramer also said that Zoom Video, Okta, RingCentral, Twilio, Etsy and Wix.com — all enjoying gains in the range of 58% and 276% this year, could see some downside in the near term.

"Coming into this session, these stocks had 8-straight days of rallies. That's unnatural," the host said. "When you get that kind of move, it always brings in sellers, and that's because people start thinking that they're parabolic."

Disclosure: Cramer's charitable trust owns shares of Amazon, Apple, Alphabet, Facebook and Microsoft.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com