So far this month Salesforce, whose cloud software helps corporate salespeople stay on top of their leads, is managing to stay more valuable than one of its longstanding competitors, Oracle. Salesforce's market capitalization now stands at $180 billion, compared with $174 billion for Oracle. So far this year Salesforce shares have increased 23%, while Oracle's have risen 9%.

The development comes after Salesforce built greater and greater control of its original market, diversified and saw its internet-delivered software model validated by dozen of other companies, including Salesforce itself.

There's also a lot of history between the companies. Marc Benioff, the co-founder and CEO of Salesforce, once worked for Larry Ellison, Oracle's co-founder, chairman and chief technology officer. Benioff has called Ellison his mentor. Ellison invested $2 million in Salesforce and became its inaugural board member. The two men had a falling-out as Oracle began challenging Salesforce, and for years they have belittled each other's companies.

"I honestly don't see Oracle as a competitor," Benioff was quoted as saying in 2010. Now his company is bigger than Oracle. An Oracle spokesperson declined to comment.

Salesforce, once derided as a company that favored growth over consistent profits, has grown up. It's been profitable for 10 of the 12 most recent quarters, and acquisitions have helped the company become less reliant on its premier Sales Cloud product.

Almost all of Salesforce's revenue comes from subscriptions and support. In the company's most recent quarter, the largest proportion of that subscriptions and support revenue was in the "Platform and Other" category, which includes contributions from integration software MuleSoft and charting tool Tableau, which were acquired in 2018 and 2019, respectively. Platform and Other delivered 30% of subscription and support revenue, compared with 15% five years ago.

Declaring victory

Even before those acquisitions, Benioff declared victory over Oracle in 2017 in a race to achieve $10 billion in cloud revenue.

Salesforce has expanded its business in part by concentrating more on individual industries. And some credit for that goes to Keith Block, a former Oracle executive whom Salesforce hired in 2013 and elevated to co-CEO alongside Benioff in 2018.

The industry effort, touching on products like the Financial Services Cloud and Health Cloud, is "an unbelievable business," Benioff said on a 2018 conference call.

Block resigned in February, leaving Benioff as sole CEO again. He still can't resist crowing about his company's ever-growing market share, which comes partly at the expense of Oracle.

"I was excited to see in the quarter and for the seventh time in a row, IDC has ranked Salesforce as the number one CRM," he told analysts on the company's quarterly earnings call in May. In the quarter Salesforce's revenue had grown 30% year over year; in Oracle's most recent quarter, revenue was down 6%.

Ellison remains about eight times richer than Benioff, according to estimates from Bloomberg. In a meeting with analysts in 2015 Ellison said that he missed the cloud. Moments later, he suggested that an early cloud company was his idea.

I believed in this running things on the Internet, renting services, for a very long time. In fact, I think the first cloud company was called NetSuite. I still own a majority of NetSuite. And creating NetSuite was kind of my idea. It was my idea to build ERP [enterprise resource planning] for small business in the cloud. And the next company that came out was Salesforce.com. They came about nine months after NetSuite. And I was a large investor in Salesforce.com and very supportive of that. In fact, Salesforce.com, if you will, was a copy of NetSuite in the sense NetSuite said, okay, were going to put ERP in the cloud and that was Evan Goldberg. And then Marc Benioff said, hey, that's a cool idea. I'm going to put CRM in the cloud. It wasn't called the cloud; it was called SaaS [software as a service]. And they happened about nine months apart.

In the past decade Oracle has sought to become more cloud-oriented, both by building its own cloud infrastructure to challenge Amazon and by buying companies like NetSuite. Salesforce has nevertheless remained the more obvious cloud company between the two.

Margin opportunity

Other cloud stocks, like DocuSign and Zoom, have outperformed Salesforce this year, with demand flowing to services that enable people to work productively while staying at home during the coronavirus pandemic. The WisdomTree Cloud Computing Fund, an exchange-traded fund based on Bessemer Venture Partners' Nasdaq Emerging Cloud Index, is up 67% for the year.

So while Salesforce is still growing, some younger and smaller cloud companies are growing faster.

As it surpasses Oracle, some investors would like to see more from Salesforce in the way of profit. Evercore analysts led by Kirk Materne explained the situation in a note to clients on June 23:

As CRM continues to scale and its organic growth rate normalizes into the high teens, the company's ability to attract new investors that are more focused on cash flow generation has been marred by some of the recent acquisitions, as well as what is perceived as a "lukewarm" commitment to driving operating leverage. This has led to CRM being "trapped" between two investment camps as it's not growing fast enough to attract momentum investors that are focused on earlier stage SaaS "category killers," and it's not profitable enough to attract more GARP-y [growth at a reasonable price] investors who have outperformed by owning software leaders, such as Adobe and Microsoft.

The analysts, who have the equivalent of a buy rating on Salesforce stock, came up with a few places where Salesforce can cut costs, including advertising and events. Raising its operating margin could lift Salesforce stock further, they argued, and that could put further distance between the company and Oracle.

"Delivering slightly higher organic margin expansion and cash flow could help drive a re-rate in the share price and a higher share price HELPS CRM's long-term GROWTH ambitions as it provides more optionality around M&A," they wrote.

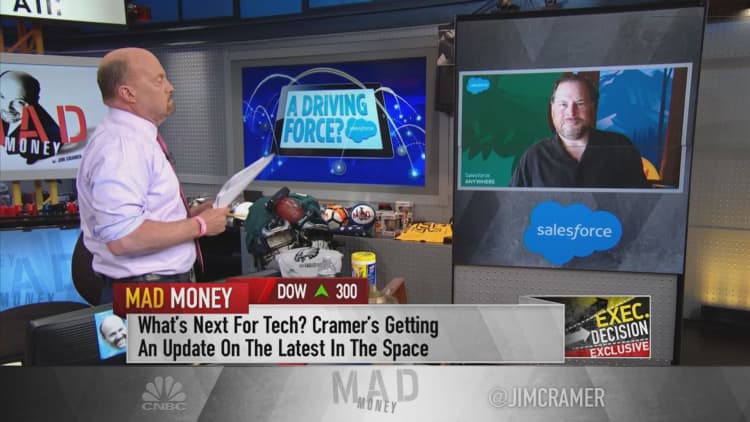

WATCH: Salesforce CEO Marc Benioff: Companies must reassess to maintain market share and innovation