As the world has battled the deadly coronavirus and financial markets have turned volatile, a small biopharma company, NanoViricides, began a press tour claiming to be close to clinical trials for a treatment for Covid-19.

The media appearances and press releases started in late January, sometimes appearing to send the stock soaring.

"What we have built is actually a Venus flytrap for viruses," Anil Diwan, NanoViricides' president and chairman, said in an interview with Fox Business on Jan. 23.

When asked in the interview if that was reality, Diwan conceded it was not yet.

Nevertheless, five days later, on Jan. 28, Diwan was on Fox Business again with this promise of things to come: "In the best-case scenario, we are between four to six weeks away from having a candidate in hand."

Investors took note. The news sent NanoViricides' stock briefly soaring from under $4 to nearly $17 per share. In the wake of this report, the stock plunged more than 10 percent Tuesday morning to below $7.

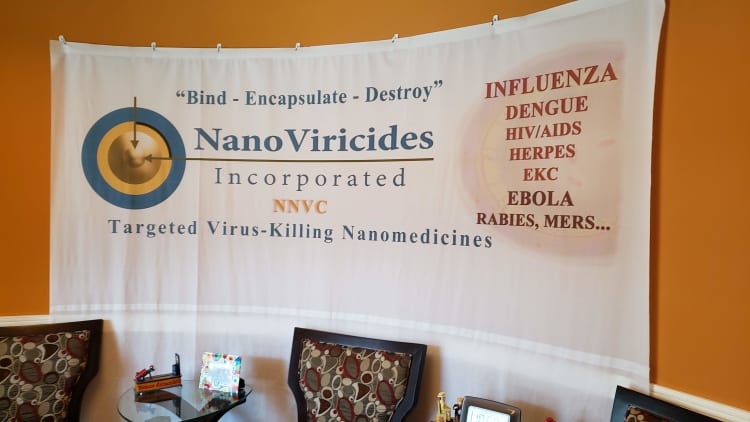

NanoViricides is a 15-year-old drug development company based in Shelton, Connecticut, with a market cap of more than $77 million on Monday. It was added to the Russell Microcap index in late June.

However, investors may be leery of the company's history. CNBC found that this coronavirus isn't the first time the company's stock has shot up during a global health scare apparently due to press releases.

In a stock prospectus filed July 9, the company revealed it has no revenue and has never had a candidate ready for clinical trials in humans.

The company released its latest quarterly report on June 22. NanoViricides said it had a net loss of $11.6 million for the nine-month period ended March 31. The company said it has $6.1 million in cash available.

Since Diwan appeared on Fox, NanoViricides has issued more than a dozen press releases about its work on coronavirus.

And in late March, NanoViricides invited the media to cover Sen. Richard Blumenthal, D-Conn., touring the company's headquarters.

Blumenthal's office did not respond to CNBC's request for an interview or comment.

Five months after the second Fox appearance, the company does not yet appear to have a lead compound, the molecule most likely to become an approved medicine.

"Companies don't normally talk a lot about their early stage drug discovery programs," said Ryan Murr, a partner at the law firm Gibson, Dunn & Crutcher who specializes in securities law in the biopharma space. "Most of the disclosures that companies put out relate to programs that are either nearing the clinic or are in human clinical studies. But it's unusual for companies to talk a lot about programs where they're still identifying the lead compound."

Diwan has continued to make promises of things to come.

"We should be able to get into humans in about six to eight weeks. That's our estimate," he said April 8 on a BioCT virtual panel with other Connecticut companies working on coronavirus. BioCT promotes and represents the bioscience community in the state.

The company has made announcements about drug developments during other global health scares, such as Ebola, bird flu and swine flu (H1N1). Each time, the company's stock appeared to rise on the news before falling.

In an interview with CNBC, Dr. Eugene Seymour, NanoViricides' co-founder with Diwan, said those releases were not intended to increase the stock price. He was the CEO when those press releases were sent out.

"We had attorneys looking at every press release. So there was nothing that wasn't truthful," said Seymour, a medical doctor who was NanoViricides' CEO from its founding until he retired in 2018. "Did it reflect my excitement, my optimism? That's who I am."

Seymour said he is no longer involved with the company but still owns restricted stock.

"The purpose was really to keep people informed as to what we were doing. And keep them, the public, as excited as I was with the potential of this technology. It just took a heck of a lot longer than I ever thought it was going to take," he said.

Those press releases may have been premature. NanoViricides' stock prospectus from May warned: "We have no customers, products or revenues to date, and may never achieve revenues or profitable operations."

In order for a company to start human clinical trials, it must get authorization from the Food and Drug Administration, according to the agency. The request for authorization is called an Investigational New Drug Application, or IND.

NanoViricides said in its latest quarterly report that it is in the process of writing its first IND for a shingles rash drug. In a press release Monday, the company said it plans to request a pre-IND meeting with the FDA on its Covid-19 treatment to get regulatory guidance.

"They've had something for shingles, they've had something for hepatitis C," said Harmon Aronson, a member of NanoViricides' scientific advisory board. "In every case they have supposedly [had] great results in cell studies. And then it never goes further. For some reason they have some reason not to pursue it."

Aronson said he has been on the advisory board for at least 10 years but hasn't done anything for the company in two or three years. He said he is not paid but gets stock options, which he has not exercised.

"After awhile I just didn't like this constant recycling of products and never getting beyond the initial stage," Aronson said.

"I think they truly believe they are doing something right. It wasn't a scam to write press releases just to raise money."

How has the company stayed in business without any revenue? It appears mostly to be from issuing new shares of stock for investors.

On Jan. 24, the day after the first appearance by Diwan on Fox Business, the company announced it closed a public offering of 2.5 million shares of stock.

Then, on May 21, the company announced it sold 1.4 million of those shares and made $9.3 million in net proceeds, according to an 8-K disclosure filed about the sale.

On Monday, NanoViricides announced that it closed an $11.5 million public offering and made approximately $10.53 million before legal and accounting expenses.

When asked about funding in general, Seymour said the company is "funded by investors having the feeling that this is going to be successful."

Even though NanoViricides has not had any revenue, Diwan and Chief Financial Officer Meeta Vyas, who is his wife, together made $743,000 in salary and stock in 2019, according to a stock prospectus filed in January. But that's just a small fraction of what Diwan receives from NanoViricides.

NanoViricides' drug development is based on special technology that attacks and destroys viruses, according to the company's website. That technology is patented by TheraCour Pharma, a privately owned company. NanoViricides paid TheraCour nearly $9.7 million for development and other costs over three years, according to NanoViricides' latest annual report, for the period ending June 2019.

"The Company pays TheraCour for the R&D work asked to be performed by the Company to develop these drugs, their chemistries, formulations, and manufacturing processes, substantially at cost, with a certain fee as specified in the license agreements," the annual report said.

And who owns TheraCour? "Anil Diwan owns approximately 90% of the capital stock of TheraCour," according to that annual report.

NanoViricides' May 21 stock prospectus mentions a third company, AllExcel, which was also recently added to Diwan's bio on NanoViricides' website. According to the bio, Diwan founded AllExcel, which is "a company with diverse portfolios including nanomedicines, small chemicals, device technologies, as well as informatics."

"Dr. Diwan may have conflicting fiduciary duties between us, TheraCour and AllExcel, for which he must recuse himself from certain of our decision-making processes," the prospectus said.

The company's most recent quarterly statement, filed June 22, also mentioned AllExcel. "The patents have been assigned to AllExcel, Inc., the Company at which the groundbreaking work was performed. AllExcel, Inc. has contractually transferred this intellectual property to TheraCour Pharma, Inc.," the company said in the 10-Q.

CNBC reached out to NanoViricides, which initially agreed to an interview in February.

"Dr. Anil Diwan, President & Chairman of NNVC would be delighted to do the interview," Vyas said in an email. Diwan has a doctorate degree from Rice University, according to the company.

However, the next day Diwan declined to show up and Vyas left this voicemail:

"Dr. Diwan will not be making it today to see you. He is very tied up in the lab working obviously on important developments," she said.

Instead, the company sent a statement to CNBC.

"The answers to all of your other questions are already publicly available in our press releases, regulatory filings, and on our website," the statement from Diwan said.

Despite the press releases and media appearances on coronavirus, Diwan said the company is focused on a different disease.

"Our priority remains our lead drug candidate for the treatment of shingles rash. ... We have limited resources that we must judiciously prioritize towards making our drug development programs successful," he said in that email. "We are performing activities for the coronavirus project solely from a humanitarian perspective."

Vyas confirmed by email in late April that this remained correct. The company has not responded to CNBC's follow-up questions.

CNBC also asked NanoViricides to clarify the relationship between TheraCour, AllExcel and NanoViricides, and any cash payments to AllExcel, but NanoViricides did not respond.

Seymour acknowledged that if he were an investor, he would be cautious about NanoViricides.

"I'd say, 'Why aren't these guys creating some drug that goes into human trials and gets into the marketplace?'" he said.

But he added that it is not unusual for that process to take many years.

"If you look at the time it takes other companies to get a novel technology into human trials, 15 years is not that unusual," he said in an email after the interview.

In that email, he also defended the company's strategy. "The system is stacked against start-up Companies with novel technologies. ... That's why having a basket of drugs maybe wasn't such a bad idea because it gave us an opportunity to pivot if we were stymied by the FDA."

Aronson said he is hopeful NanoViricides will develop a drug for Covid-19.

"I've always been concerned about a pandemic the last 10 years. I was always hopeful [Diwan] would come up with something when Covid-19 came about. I said here it is. And they had nothing. I was just very disappointed," he said.

Murr, the biopharma securities lawyer, said most companies get to human trials sooner.

"I think if I was an investor, I'd want to understand what about this program made the company think that it was going to be successful, where the success rate for early stage programs is, statistically speaking, quite low," he said.

He said companies need to be extra careful during epidemics or public crises not to be viewed as opportunistic.

"They should be programs that they can substantiate and back up the claims that they actually have meaningful progress and something tangible to advance and to ultimately move into the clinic."

Please email tips to investigations@cnbc.com.