Whether you are laid off, furloughed or changing jobs, it's important to carefully consider what to do with the money you have stashed away in your 401(k). Surprisingly, if the savings are minimal, many people forget about it or simply cash it out. This could lead to missed opportunities for building up a healthy retirement nest egg.

Now a new feature will soon encourage workers to hang on to those smaller sums. Called auto portability, it lets you move your 401(k) account from your old job to a new employer's 401(k) plan — automatically.

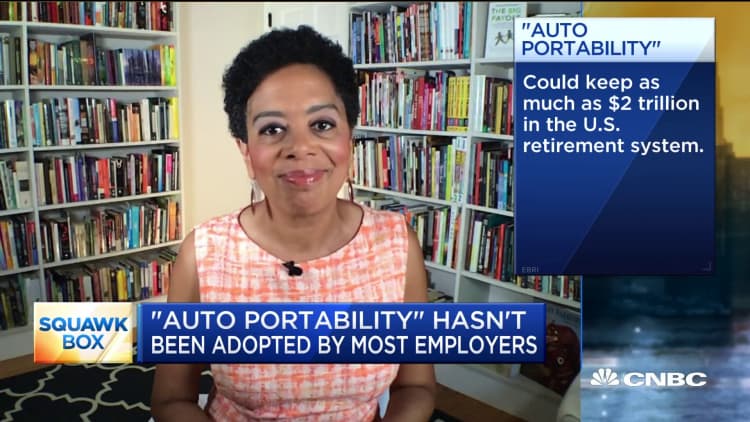

Researchers at the Employee Benefit Research Institute say using technology to enable auto portability of 401(k) plans could keep as much as $2 trillion in the U.S. retirement system.

More from Invest in You:

If you left or lost your job, here is what you can do with your 401(k)

What you need to know before taking out a home equity loan or borrowing from your 401(k)

Nearly 1 in 5 working women have nothing saved for retirement

Retirement Clearinghouse, which developed the auto portability feature, and Alight Solutions announced Tuesday that Alight will be the first 401(k) plan provider to adopt auto portability, with 185 companies and about 5 million employees able to have access to this feature by the end of the year.

This changes what happens to your 401(k), even if you do nothing. "Today if the worker does nothing, they either get a check with taxes and penalties withheld or the money goes into a safe harbor IRA — this is for balances of less than $5,000. There, it's invested in money market or stable value funds," Alight Solutions executive vice president Alison Borland said on CNBC's "Squawk Box" Tuesday.

"What happens in the new world with auto portability if the worker does nothing, when they find a new job, the 401(k) automatically follows them. They don't have to take any action," Borland said.

"If people know that they have an alternative to cash out, they know their 401(k) will follow them when they move from job to job, believe it or not, that human behavior says, 'Let me think about it,'" RLJ Companies' founder Bob Johnson told CNBC. He is a majority stakeholder in Retirement Clearinghouse.

Fidelity and Vanguard, the nation's largest 401(k) plan providers, are not yet offering auto portability for their 401(k) plans, and most employers have not adopted this feature.

Managing your 401(k)

According to a 2019 report by Alight Solutions, over a 10-year period from 2008 to 2017, 4 out of 10 terminated participants cashed out the entire balance of their 401(k) account. The share who cashed out rose to 80% for those who had balances under $1,000 and over 50% for terminated participants with balances up to $10,000.

While every situation is unique, cashing out and taking a lump-sum distribution is rarely a good idea, as savers under age 59½ pay a 10% penalty on top of any taxes owed.

Source: Alight Solutions

But there are several options to take into account when it comes to managing your 401(k). This applies to whether you are one of the 18 million who have lost their jobs during the coronavirus pandemic or if you are starting a new job with a new 401(k) plan.

These options include moving the money to a new employer's 401(k); leaving it in your former employer's 401(k) plan; rolling it over into an individual retirement account (IRA), which may happen automatically if it's a small balance; or cashing it out completely.

Research shows that participants with larger 401(k) account balances may be more likely to roll over the their 401(k) assets to their new employer's 401(k) plan or an IRA on their own.

Nevin Adams, chief content officer of the American Retirement Association, a trade organization representing retirement plan professionals, including plan sponsors, says "the cost of keeping up with the small accounts of former workers, coupled with the expense of providing legally required plan notices, can be a deterrent to keeping those balances in the plan."

Also, "the administrative burden of taking on small rollover accounts can be a disincentive for both workers and their new employer to bother," he said.

But Alight's Borland is optimistic that many employers will want to sign on. "From our clients' perspective, the feedback has been overwhelmingly positive," she said. "So we expect high adoption, and we expect this change in the industry to be able to happen."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How I became a millionaire in my 30s and retired early by learning to invest during the 2008 recession via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.