CNBC's Jim Cramer said Tuesday that "it's time to admit that these moves are crazy" after large gains by some of the market's biggest tech stocks pushed the Nasdaq Composite to another record high the previous day, but he is not predicting a reversal.

Expanding on a tweet in which he called the market moves "truly insane," Cramer said that big surges by major stocks were unlike anything he had ever seen but were substantially different than the tech bubble of the late 1990s.

"Insanity does not mean it's over. Insanity just means can we please just stop comparing it to 1999, because in 1999 a lot of really bad companies gained a lot of market cap. Here, a lot of unbelievably great companies are gaining market cap at a pace that you've got to give them a speeding ticket," Cramer said on "Squawk Box."

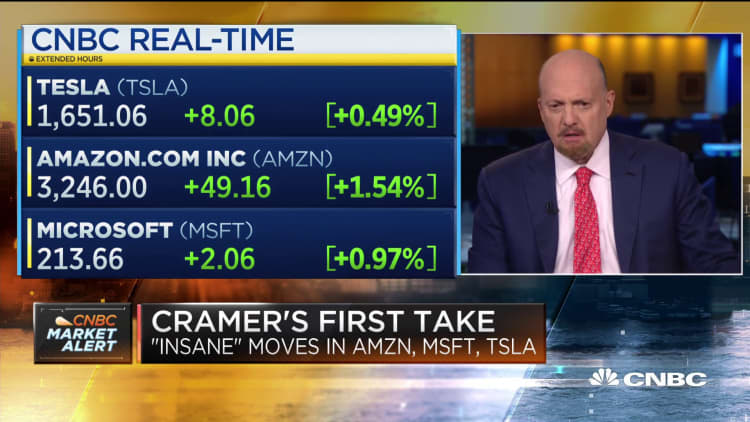

As examples, he pointed to Amazon, Tesla, Nvidia and Microsoft, which he said was "trading like a small cap." Microsoft and Amazon are two of the largest companies in the world, with market caps above $1.5 trillion.

All four of those stocks have outpaced the market this year, ranging from a 34% gain for Microsoft to a nearly 300% surge for the electric car company.

The performance of these names has propelled the Nasdaq well beyond the S&P 500 this year. The tech-heavy index closed Monday up 20% for the year, while the S&P 500 was essentially flat.