As the retail industry undergoes a seismic shift because of the coronavirus pandemic, its workforce is more vulnerable than ever.

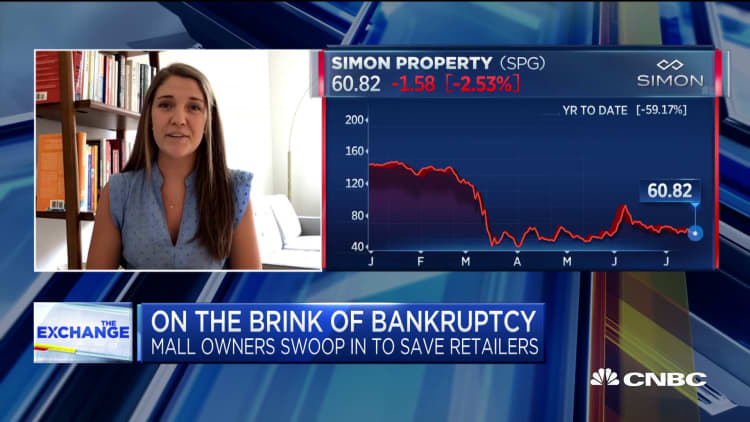

Permanent store closures number in the thousands, putting them on pace to break records. Dozens of retailers have filed for bankruptcy — while others remain at risk. Meantime, a growing number of customers want to shop online and get their purchases through curbside pickup or home delivery, creating a much greater need for people to pick and pack items.

These fast-changing dynamics have led to a shakeout for workers. They've been hired, furloughed, laid off or assigned to new roles. Retailers, analysts and trade groups say the pandemic could change the size and makeup of the retail industry now, and for years to come.

Read more: Retail workers slammed by job cuts, pushed into new roles as coronavirus shakes their industry

More than one in four American jobs were supported by the retail industry before the Covid-19 crisis hit the U.S., according to the National Retail Federation. That made retail the largest private sector-employer in the country. (That number includes people who work directly for a retailer, like at an apparel store, warehouse or coffee shop. It also includes jobs created by the industry, such as construction workers building a mall.)

During the pandemic, the number of workers in stores has gotten smaller, according to the U.S. Bureau of Labor Statistics. Nearly 15.7 million were employed by retailers in February. That dropped by about 2.4 million in March and April, but recovered somewhat in May and June as stores began to reopen. About 14.4 million employees made up the workforce, as of June.

There were 1.9 million store-based retail workers unemployed — with about 1.1 million of those classified as temporary layoffs, such as furloughs — in June according to the U.S. Bureau of Labor Statistics.

Analysts believe that after the pandemic, the workforce could remain smaller or shrink further as retailers discover they can't make payroll with the same headcount as costs from wages to sanitizing stores rise or learn they can operate with a leaner staff.

"If retailers discover that they can do more with less, we may see a permanent decline in the total number of retail workers," Forrester analyst Sucharita Kodali said.

She said e-commerce operations also tend to run leaner. "The warehouse is made for kind of the minimum number of people who have to be there to pick and pack orders," she said.

Kent Knudson, a partner in Bain & Company's retail practice, said the long-term losses will be largest among department stores and other specialty apparel retailers that already struggled before the pandemic. For some, he said, shuttered stores during the lockdowns amounted to a final blow.

That's already reflected by recent data from the Labor Department. Retail employment is down by nearly 13% year over year, as of June, but it's fallen by more than 50% for retailers that sell clothing.

The federal agency's labor classification for retail is made up of predominantly store-based employees and doesn't include some retail-related jobs, such as truck drivers or warehouse employees.

Grocers and warehouse clubs have been among the rare bright spots, as they hire more people to keep up with strong sales.

Knudson said the future of the retail workforce will depend, at least in the near-term, on two major upcoming shopping seasons: back-to-school and the holidays.

If shoppers return to stores or step up their shopping online, retailers will need to bring more furloughed workers back or at least maintain their staffing levels. If they pull back on spending because of unemployment or economic uncertainty, it will "accelerate the downward trajectory," he said.