CNBC's Jim Cramer on Thursday helped investors make sense of the crowded race for a coronavirus vaccine, breaking down which of the competitors have stocks worthy of being bought.

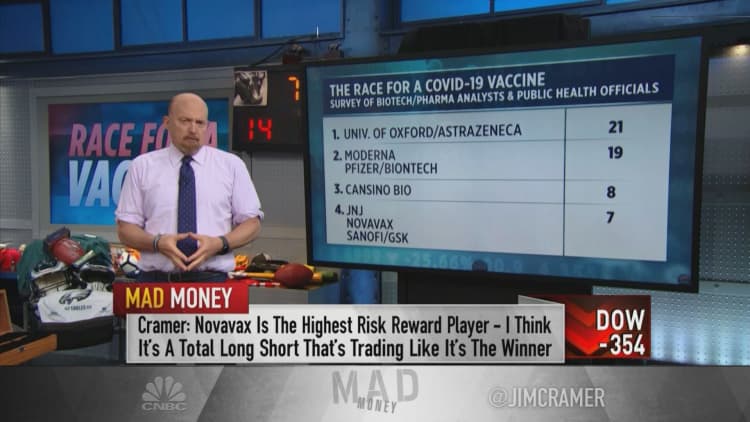

Emphasizing the importance of a vaccine to prevent Covid-19, the "Mad Money" host said the show took a survey of 92 drug analysts and public health officials to better understand where things stand — and where they may go.

"Our fate is in the hands of a few dozen companies with a dizzying array of clinical trials, and whoever gets there first is going to make a lot of money for shareholders," Cramer said.

Oxford University/AstraZeneca

The potential vaccine developed by Oxford University with pharmaceutical giant AstraZeneca came in first, with 21 respondents selecting it as most likely to win the race, Cramer said.

Data published earlier this week from a large, early stage human trial showed the vaccine candidate produced a promising immune response. Much work remains, Cramer cautioned.

But he said he believes AstraZeneca's stock is worth a look. It has a decent dividend and a strong anti-cancer product line and has fallen back from its 52-week high of $64.94, he said. It closed Thursday at $55.17.

"Why did people sell the news? I think the expectations got out of control. Buyers seemed to want some sort of miracle, instead they got something very positive but still within the bounds of reason," Cramer said.

Moderna and Pfizer/BioNTech

Cramer said that second place in the survey was a tie between Moderna and the joint effort from Pfizer and biotech firm BioNTech. They received 19 votes apiece, he said.

Of the three stocks, Cramer said he favors Pfizer, the New York-based drugmaker. Its stock closed Thursday's session at $38.41 and is down nearly 2% so far in 2020.

"Pfizer has a portfolio of decent, albeit boring, drugs, and while there's nothing huge in the pipeline, the company's got very deep pockets, so if their vaccine doesn't win, they can always make some very exciting acquisitions," Cramer said.

By contrast, Cramer said that Pfizer's partner in the vaccine effort, BioNTech, has less upside potential if the attempts to produce an effective vaccine for Covid-19 are unsuccessful. Shares of the German biotech firm closed down 15% on Thursday at $88.51 per share. Its stock has run up more than 160% this year.

"BioNTech's stock is too binary for me. They don't have enough other shots on goal," Cramer said, one day after both firms announced they had a nearly $2 billion agreement with the U.S. government if the vaccine proves effective.

Cramer said he used to be a fan of Moderna, citing its use of artificial intelligence in its development practices. But recently, he said, he has started to sour on the Cambridge, Massachusetts-based firm. Valuation also is a concern, he added.

"I think Moderna's become too promotional, too quick to praise its own work off a very small sample size, which is odd because they've never actually produced a vaccine before," he said. "Now I did love this stock in the [$]20s and [$]30s and [$]40s and even in [$]50s, but up here at $75? ... I now say, no, thank you."

J&J, Novavax and Sanofi/GlaxoSmithKline

Next up was CanSino Biologics, a Chinese vaccine company. It received eight votes. However, Cramer said he couldn't say much about the stock. E-commerce giant Alibaba is the only Chinese stock he will recommend, he said.

The following vaccine ventures all received seven votes: Johnson & Johnson, Novavax, and the team of Sanofi and GlaxoSmithKline.

Cramer said that Johnson & Johnson is his favorite stock of the four. Although its vaccine candidate is only in phase one, Cramer said, he has heard good things about it. But beyond that, the company offers investors more than just boom-or-bust potential with the vaccine, he said.

Plus, at about $150 per share, the valuation is attractive, he said.

"J&J has the best pipeline of these drug companies," said Cramer. "Their vaccine could fail and the stock wouldn't even go down. That's how cheap this thing is. I think it's a buy right here."

Cramer also said he saw promise in the vaccine effort from Sanofi, a French drugmaker, and British firm GlaxoSmithKline.

"I think the Sanofi-Glaxo candidate has great possibilities, because both companies have excellent vaccine divisions, though they're late to the party," he said.

Investors should be wary of Novavax, Cramer said, calling it a high-risk but high-reward option. The stock closed Thursday at $139.59 per share. For the year, it is up a striking 3,407%.

"It's a total longshot that's trading like it already won. Why? Because of a $1.6 billion commitment from the President's Operation Warp Speed initiative," Cramer said.

Bottom line

The race to develop a vaccine for Covid-19 is not a zero-sum game, Cramer said. It is possible that multiple companies develop successful vaccines, he said.

For investors, Johnson & Johnson is the best place to look right now among the vaccine candidates, he said. He added that he also likes Regeneron, for both its potential Covid-19 treatment and its other line of products.

On the other hand, Cramer said investors should sell Inovio Pharmaceuticals, shares of which are up more than 600% this year, based on the feedback from the expert survey.

"If you want to make an informed wager or at least invest on the vaccine stocks, I think AstraZeneca has the most promising formulation," he said. "However, J&J has the best stock, because it's inexpensive and it's got so much else going if turns out to be a loser in the Covid-19 vaccine race for a cure or, at least, immunity."

Disclosure: Cramer's charitable trust owns shares of Johnson & Johnson.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com