CNBC's Jim Cramer on Friday took a look at the week ahead for Wall Street and gave his thoughts on the newsiest events marked on his calendar.

"I know it's not a huge news week, but this market's badly in need of another stimulus package," the "Mad Money" host said. "I think the next move hinges on whether or not Congress can get its act together to pass something, an event the market needs to break out of its doldrums."

The comments come after the stock market toiled through a mixed day of trading to close out one of the most volatile weeks for stocks in months.

The Nasdaq Composite was the only major index to fall during the session, slipping 0.6% to 10,853.54 at the close as Big Tech stocks continued to decline from record highs.

The S&P 500 inched up just 0.05% to 3,340.97, and the 30-stock Dow moved up 131.06 points for a 0.48% growth to 27,665.64.

The S&P 500 experienced its worst week since late June and its second-straight weekly loss for the first time since May. The tech-heavy Nasdaq dropped more than 4% this week, its steepest decline since March.

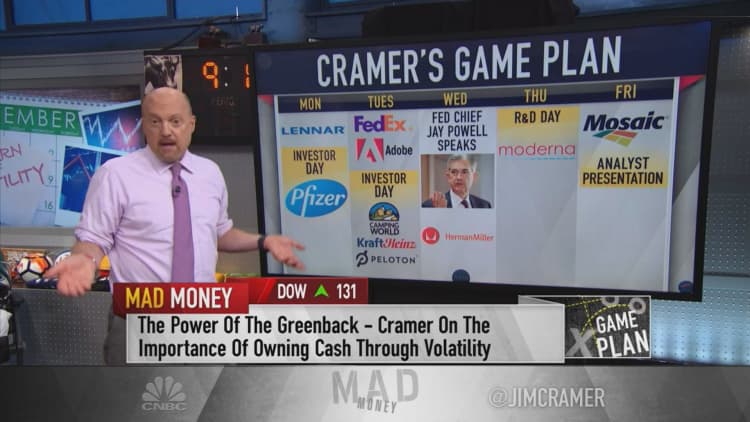

Below is a snapshot of Cramer's thoughts on earnings reports and corporate events to come. All projections are based on FactSet estimates:

Monday: Lennar earnings; Pfizer analyst meeting

- Q3 fiscal 2020 earnings release: after market; conference call: Sept. 15, 11 a.m.

- Projected EPS: $1.55

- Projected revenue: $5.33 billion

"We know housing's been among the strongest groups this year, thanks to low mortgage rates and the counter-urban trade. That's how Lennar could rally 37% for 2020," Cramer said. "I want to know if Lennar's building offices into houses and if potential homeowners want those features."

- Investor Day, Day 1: 1 p.m.

- Investor Day, Day 2: 10 a.m.

"There's no way anyone makes big money off a vaccine. Every country on Earth is going to put price controls on this thing," he said. "When it comes to Big Pharma, I care about potential blockbusters, and that's why I'll be paying close attention when Pfizer holds its virtual analyst meeting on Monday."

Tuesday: FedEx, Adobe earnings; Camping World, KraftHeinz, Peloton analyst meetings

- Q1 fiscal 2021 earnings release: 4:45 p.m.; conference call: 5:30 p.m.

- Projected EPS: $2.67

- Projected revenue: $17.5 billion

"FedEx can talk Christmas surcharge," Cramer said, "and overseas strength, including China. I bet they'll be ready for the holidays this time. I'm so confident about this one that if it rallies too much on Monday ... go buy some United Parcel because I think the pin action is going to be incredibly strong."

- Q3 fiscal 2020 earnings release: 4:05 p.m.; conference call: 5:00 p.m.

- Projected EPS: $2.41

- Projected revenue: $3.16 billion

"No fewer than five analysts have boosted numbers or upgraded this company in the last five days, and I'm betting Adobe could have a very good year in 2021," he said.

- Investor Day: 12 p.m.

"I bet it goes higher after CEO Marcus Lemonis ... fleshes out how amazingly positive the pandemic has been for the camping business," the host said. "In this age of social distancing, camping's arguably the safest way to take a vacation. I think Camping World is crushing it."

- Investor Day: 8 a.m.

"When we got into that lockdown, the company got some real adherents as their old brands suddenly came back to life," he said. "But now the pantry's been stocked, and we have to wonder whether Kraft Heinz is seeing continued strength like B&G Foods or Campbell Soup."

- Analyst and Investor Meeting: 1 p.m.

"Just when you thought we'd heard enough about Peloton after last night's phenomenal quarter, they're holding an analyst meeting, too," he said. "Promising new equipment, maybe even more of an ecosystem. As long as gyms are closed because they're potential Covid hotspots, Peloton should keep selling lots of exercise equipment."

Wednesday: Federal Reserve briefing; Herman Miller earnings

Fed Chairman Jerome Powell is expected to hold a briefing after the central bank wraps up its final two-day meeting before the November election.

"I think he'll urge Congress to pass some kind of bailout for the industries that have been forced to shut down," Cramer said.

- Q1 fiscal 2021 earnings release: after market; conference call: Sept. 17, 9:30 a.m.

- Projected EPS: 26 cents

- Projected revenue: $525 million

"I keep wondering why the heck the stock of Herman Miller, the maker of stylish office chairs, has basically been flatlining for months," he said. "Everyone else that's connected to the remote work thesis is on fire."

Thursday: Moderna

- R&D Day: 8 a.m.

"I'd love to hear what else they have in the pipe besides their potential Covid-19 franchise. Maybe they'll give us an update on how the big vaccine trial is going," Cramer said.

Friday: Mosaic

- Analyst meeting: 9 a.m.

"If Mosaic says anything good about farmers, that should immediately translate into even more buying in the stock of John Deere, which has been an incredible performer," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com