CNBC's Jim Cramer on Monday gave his recommendation on the looming public debut of DoorDash.

The San Francisco-based food delivery app received praise from Cramer, though he erred on the side of caution as to what price he thinks investors should be willing to pay for it when it begins trading publicly.

"DoorDash is a terrific story, but its business could slow dramatically next year, so I recommend being careful with it," the "Mad Money" host said. "If you can get it for $100 or less, you've got my blessing. Otherwise, sorry, you had to get in on the deal because you can't chase these."

In the nine months ended Sept. 30, DoorDash brought in nearly $2 billion in revenue, compared to $587 million in the same window in 2019. The company during that same period recorded a net loss of $149 million, a 72% decline in comparison to the first nine months in 2019. In its November IPO filing, DoorDash indicated that revenue blossomed, leading to its first quarterly profit.

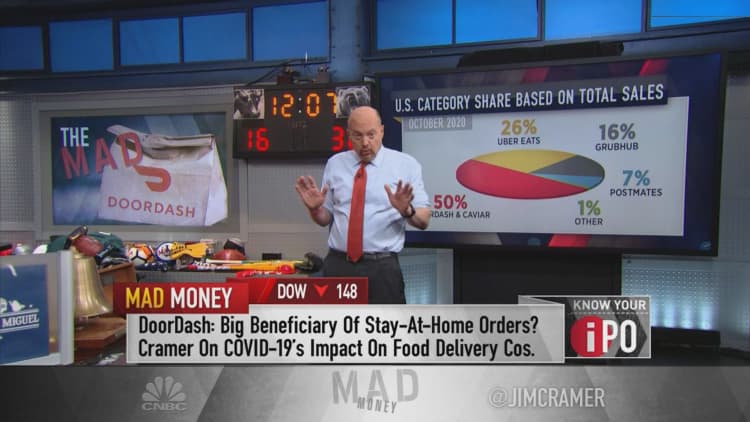

Analytics firm Second Measure estimates that DoorDash and its related businesses had a roughly 50% share of U.S. delivery sales in October, a month in which sales in meal delivery services grew 135%.

"Anyone who wasn't already using these platforms to get food delivered is now a convert," Cramer said. "Sure, the whole industry will take a revenue haircut when the vaccine's widely distributed and restaurants can reopen for regular non-socially-distanced in-person dining, but a company like DoorDash should still be years ahead of where we expected them to be in 2021."

DoorDash, the largest restaurant delivery provider in the U.S., plans to raise as much as $3.14 billion when it issues 33 million shares in a public offering. The company revised its price range between $90 and $95 a share, up from its initial range of $75 to $85. The IPO price will be announced Tuesday.

DoorDash's valuation would come in at about $30 billion, should it IPO at the high range.

Cramer, who has previously voiced concerns about the level of competition in the market, said he is now a believer in on-demand food delivery.

DoorDash rivals Uber Eats, Grubhub and Postmates in the delivery arena, which has seen exponential growth in customers powered in part by pandemic-era restaurant dining restrictions across the country.

After multiple mergers in roughly the past year softened the competitive landscape and the stay-at-home environment sparked demand for delivery orders, the former hedge fund manager said he is more optimistic about their profit prospects.

"My big concern here is that DoorDash is coming in hot. The numbers are fabulous right now, but we don't know how much of that is sustainable," Cramer said. "I expect the IPO to catch fire right out of the gate, even as I worry that it's destined for a pullback when the growth slows in 2021 and the company's up against some very tough comparisons."

DoorDash plans to list on the New York Stock Exchange with the ticker "DASH."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com