There's been a flurry of recent deals on Wall Street involving electric vehicles, and investors have shown a strong appetite for stocks in the space — both companies that intend to manufacture cars and those that produce supportive technology such as batteries and charging stations.

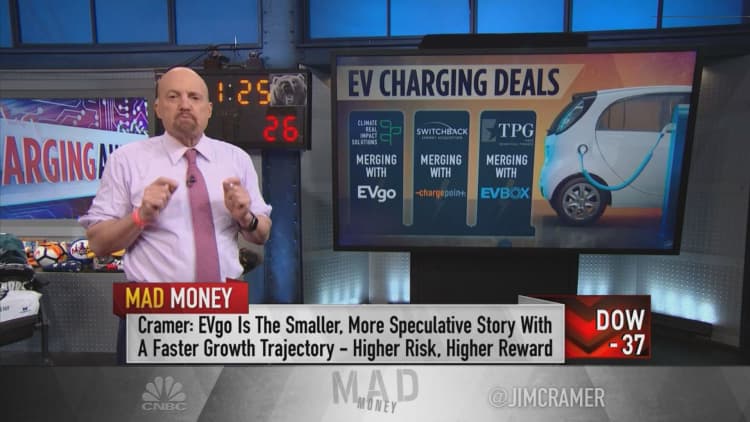

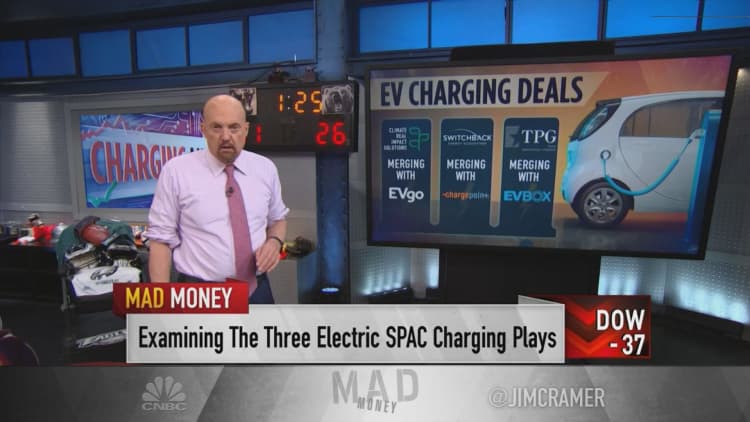

CNBC's Jim Cramer on Monday broke down three companies that fell into the charging-station category, concluding that the one investors should be most interested in is EVBox.

Last month, the company announced it would be going public through a reverse merger with TPG Pace Beneficial Finance Corp., a special purpose acquisition company. Netherlands-based EVBox's deal with the SPAC is expected to close late in the first quarter of this year.

Shares of TPG Pace Beneficial Finance Corp. closed down a little over 7% on Monday to around $24 apiece.

The other two companies Cramer analyzed on "Mad Money" were ChargePoint, which is set to merge with a SPAC called Switchback Energy Acquisition Corp., and EVgo, which recently announced its plans to merge with a SPAC called Climate Change Crisis Real Impact.

"If you want a charging station play, EVBox seems like the best of the bunch — very similar to ChargePoint but with a faster growth and a cheaper stock," Cramer said Monday. "Remember, you need to buy the SPAC, TPG Beneficial Finance, and I think you can start building a position right here at $24."

Both EVBox and California-based ChargePoint sell hardware and offer a software-as-a-service component, Cramer said, helping other entities build charging stations at their parking spaces. One of the biggest differences between the companies is that EVBox started in Europe, where it's the market leader, before expanding in the U.S., Cramer said.

"This is one industry where European exposure might be very attractive ... because their governments have been much more aggressive about pushing alternative energy," said Cramer, who has previously pointed to electric vehicles as one of the biggest investing themes now that Democratic President Joe Biden is in the White House.

For the current year, ChargePoint projects revenue growth of about 50% compared with 2020 figures, while EVBox is forecasting sales to increase by about 72%, according to Cramer.

Cramer said Los Angeles-based EVgo is "higher risk, higher reward" for investors because it's earlier in its life cycle than EVBox and ChargePoint. EVgo owns and operates the largest network of fast-charging stations for electric vehicles in the U.S., Cramer said.

"Of course, the largest public fast-charging network still isn't very large — we're talking less than 900 locations in 67 metro areas across 34 states — but EVgo's got some great partnerships," such as with General Motors, Cramer said.

Shares of EVgo's SPAC partner, Climate Change Crisis Real Impact, closed Monday's session at $19.67 apiece. Cramer said he wasn't totally opposed to investors buying the stock before its reverse merger with EVgo is complete.

For investors who "want something more speculative, you've got my blessing to pick at EVGo on weakness — that's Climate Change Crisis Real Impact — though ideally you should let it come in a bit more," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com