Stocks came under pressure Friday afternoon, reversing early gains.

The Dow Jones Industrial Average finished the day up less than 1 point at 31,494.32 after climbing more than 150 points earlier in the session. The S&P 500 finished down 0.19% at 3,906.71 while the Nasdaq Composite gained less than 0.1% to finish at 13,874.46.

Though the major indexes traded higher for most of the morning, a combination of rising interest rates and profit taking in some of the market's largest technology companies appeared to dampen optimism after noon.

For the week, the S&P 500 lost 0.71% while the Nasdaq shed 1.57%. The Dow fared better with a slight gain of 0.11%.

Cyclical stocks outperformed the broader market with the materials, energy and industrials sectors up 1.8%, 1.7% and 1.6%, respectively. Utilities and consumer staples stocks were among the biggest laggards.

Small-cap stocks, which also tend to track the ups and downs of the broader economy, clinched solid gains Friday at the expense of some of the market's largest members. The Russell 2000 added 2% while Facebook, Amazon, Netflix, and Microsoft all fell. Apple ended the week down 4%.

Not all of technology underperformed as chipmakers proved resilient. Applied Materials, which makes the equipment used to manufacture semiconductors, gave a better-than-expected second-quarter forecast after the bell Thursday. The shares gained 5.3% Friday.

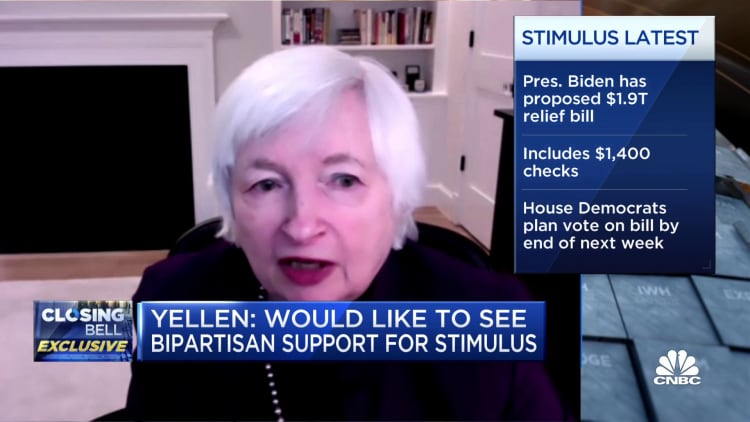

The strength among economically sensitive stocks came after Treasury Secretary Janet Yellen told CNBC Thursday after the bell that more stimulus is necessary even as some economic data suggested a rebound is already underway. She added a $1.9 trillion stimulus deal could help the U.S. get back to full employment in a year.

"We think it's very important to have a big package [that] addresses the pain this has caused – 15 million Americans behind on their rent, 24 million adults and 12 million children who don't have enough to eat, small businesses failing," Yellen told CNBC's Sara Eisen during a "Closing Bell" interview.

"I think the price of doing too little is much higher than the price of doing something big. We think that the benefits will far outweigh the costs in the longer run," she added.

Still, the stock market's rally to records stalled a bit this week as fears of rising rates and higher inflation crept in.

Some investors have said pessimism over a jump in interest rates and the potential for inflation have kept Wall Street in check in recent sessions. The 10-year Treasury yield this week rose to the highest in nearly a year, and on Friday rose another 5 basis points to 1.34%.

"I think that this week may have put a little bit of inflation fear into people. Not necessarily in the short term, but this could turn really quickly," said JJ Kinahan, chief market strategist at TD Ameritrade.

"You saw some pretty decent-sized swings this week in rates. I don't want to get too carried away – it's not like the 10-year is creeping above 2%," he continued. But "I just think that because of the velocity of how quickly we started the year, it may just be a little bit of people taking a breather."

Yellen, though, said she doesn't believe inflation should be the biggest concern.

"Inflation has been very low for over a decade, and you know it's a risk, but it's a risk that the Federal Reserve and others have tools to address," she said. "The greater risk is of scarring the people, having this pandemic take a permanent lifelong toll on their lives and livelihoods."

Many on Wall Street agree with Yellen that a large stimulus is needed and that a trillion-dollar package, along with a smooth economic reopening this year, will cause the market rally to continue.

"A big part of our rationale for additional gains from here is dependent on a continued belief that the major drivers that helped carry the market to current levels will remain intact," Scott Wren, Wells Fargo's senior global market strategist, said in a note. One of the drivers is "additional stimulus from Congress that will help bridge the gap between now and when vaccines are widely distributed."

The House of Representatives will try to pass a $1.9 trillion coronavirus relief plan before the end of February, Speaker Nancy Pelosi said Thursday. Democratic Congressional leaders may try to pass a package without votes from Republicans.

After a temporary pullback in December, homebuyers returned to the market in January despite record low supply. Closed sales of existing homes in January increased 0.6% compared with December, according to the National Association of Realtors.

Sales ended the month at a seasonally adjusted, annualized rate of 6.69 million units. That figure is 23.7% higher compared with January 2020 and the second-highest sales pace since April 2006.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.