Boeing on Wednesday posted its sixth consecutive quarterly loss as it continues to struggle with production issues and a weak jetliner market but said it expects 2021 to be a turning point as more people are vaccinated and travel again.

The plane manufacturer reported a net loss of $561 million for the first three months of 2021 on revenue of $15.2 billion, 10% lower than last year but slightly ahead of analysts' estimates. Boeing reported a $318 million pretax charge related to issues with a supplier for the modified 747 planes used as Air Force One.

Boeing's shares fell 2.9% to close at $235.46, though they are still up 10% so far this year.

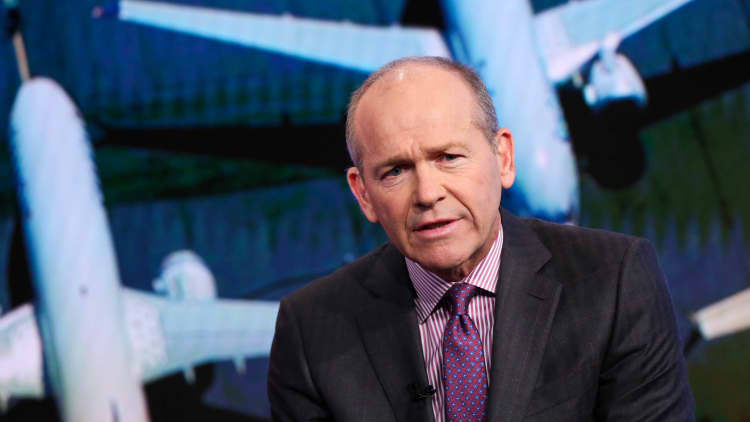

CEO Dave Calhoun was optimistic about an increase in air travel, which has been significant for large domestic markets like the U.S., but he warned that globally it will take two or three years to get back to 2019 traffic levels.

"The recovery is gaining traction but remains uneven," he said on the quarterly call Wednesday.

Rival Airbus reports first-quarter results on Thursday.

On an adjusted per-share basis, Boeing lost $1.53, a narrower loss than the adjusted $1.70 per share loss it reported a year ago.

Here are the numbers:

- Loss per share: $1.53 adjusted. Analysts had expected a per-share loss of $1.16, according to Refinitiv.

- Revenue: $15.22 billion vs. $15.02 billion expected by analysts surveyed by Refinitiv.

In addition to a weak jetliner market from the pandemic, Boeing's losses have piled up from the extended grounding of its best-selling 737 Max aircraft after two fatal crashes killed 346 people and production problems. Regulators started lifting the grounding in November 2020.

Calhoun said the company paused deliveries of the 737 Max because of electrical issues on some of the planes that has prompted the grounding of about 100 of the planes worldwide, just before the peak summer travel season. A fix has taken longer than expected.

Calhoun told CNBC's "Squawk on the Street" that the company expects the FAA to approve a fix for the planes in "relatively short order" and warned on the quarterly call that April deliveries will be light because it paused Max deliveries because of the issue.

The Max isn't Boeing's only production problem. Last month it resumed deliveries of its wide body 787 Dreamliner planes after reporting production flaws last year and sales have been slow with long-haul international travel still down sharply in the pandemic. The company expects to deliver the "majority" of its inventory of 787 planes by the end of the year.

Revenue in its commercial airplane unit fell 31% from a year ago to $4.27 billion though deliveries for new planes rose to 77 from 50. Boeing also logged new sales from customers like United and Southwest Airlines to return to plans to update their fleets and prepare for growth. In March, Boeing's new aircraft orders outpaced cancellations for the first time since 2019.

Boeing reiterated its forecast to increase production of the 737 Max to 31 a month in early 2022 and its estimate to deliver its first 777X wide-body jet in late 2023.

In a presentation, the company cited the pace of vaccinations and infection rates, U.S.-China relations and remaining 737 Max regulatory approvals, including from China, among the the risks to demand for aircraft.

Boeing hopes to end a three-year order drought with China, where sales suffered during trade tensions with the U.S., the Max grounding and the recent pandemic. Calhoun told CNBC that the company wouldn't likely have to change its Max or 787 production rates even without an order from China in the next six months.

"I will advocate as a CEO ... to our administration currently," he said. "I know they're in sort of a difficult moment with China. I am a believer that we will all come through this moment and that trade will be a big part of that."

Boeing last week raised 64-year-old Calhoun's retirement age by five years to 70 and announced its CFO and longtime executive Greg Smith, who was seen as a successor, will retire this summer.

Boeing reported negative free cash flow of $3.68 billion for the quarter, compared with negative $4.73 billion a year ago. It ended the first quarter with $63.6 billion in total debt, unchanged from the previous quarter.

Sales from its defense, space and security unit, which has become increasingly important as the commercial side of the business has struggled, rose 19% to $7.16 billion thanks to higher KC-46A tanker sales.

Meanwhile, its services business generated $3.75 billion, down 19% from a year ago.