Investors may still have opportunities to buy stocks that benefit from the potential passage of a $1 trillion infrastructure package, CNBC's Jim Cramer said Monday, pointing to technical analysis offered by ExplosiveOptions.net founder Bob Lang.

"Even though the infrastructure stocks have already run, the charts — as interpreted by Bob Lang — suggest that many of them could have a lot more upside here, especially Martin Marietta, Union Pacific, Nucor, and American Tower. I think he's got a real good point," the "Mad Money" host said.

The bipartisan infrastructure legislation passed the U.S. Senate last week, sending the proposal to upgrade the nation's roads and bridges, among other initiatives, to the House of Representatives. It must pass the Democratic-controlled House before President Joe Biden can sign it into law.

Martin Marietta

While Martin Marietta shares are up more than 34% year to date, Cramer said Lang's analysis suggests the concrete and asphalt supplier's stock may not be done moving higher.

In addition to a "solid pattern" of higher lows and higher highs, Cramer said an indicator of institutional buying and selling known as the Chaikin Money Flow shows favorable trends in recent months.

Conversely, the stock does appear to be overbought.

"Sometimes, though, overbought stocks simply stay overbought when they're really good stocks," Cramer said. "Is that possible here? Lang likes that Martin Marietta's been rallying on heavy volume."

"While you might want to let the stock cool off short-term, and that's always possible," Cramer said. Lang believes the stock, which closed Monday's session at $380.83, could eventually reach $500.

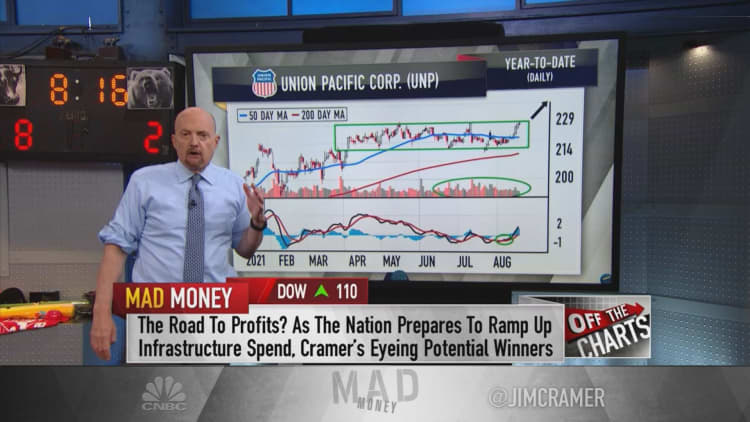

Union Pacific

Nebraska-based railroad Union Pacific has been "trading in a box" since March, Cramer said. However, the company's stock is up more than 3% in the past five days.

"Volume trends have been bullish. That means the stock tends to rally on high volume. Remember, the volume is like a polygraph—it lets you know whether or not a move is telling the truth," Cramer said.

Plus, Cramer added, the momentum indicator Moving Average Convergence Divergence recently flashed a buy signal for Union Pacific, which could benefit from the proposed infrastructure package's investments in rail and port upgrades.

"Lang thinks you could have a nice floor of support down about $7 from here," Cramer said, noting the stock has been able to hold its 50-day moving average. "If Union Pacific can break out of its box pattern by closing above $229, he expects the stock to make a run at $250 in the not-too-distant future."

Nucor

Shares of steelmaker Nucor are up more than 130% year to date, but Cramer said Lang believes the stock is in a situation "where a terrific rally on strong volume is pulling in more and more buyers."

"This is currently a $122 stock, but Lang could see it going to $150 and then maybe $175. Wow. I think he's right — fabulous moment for Nucor," Cramer said. "They were doing great even when this infrastructure package looked like it was dead in the water, so just imagine how well they'll do if it passes."

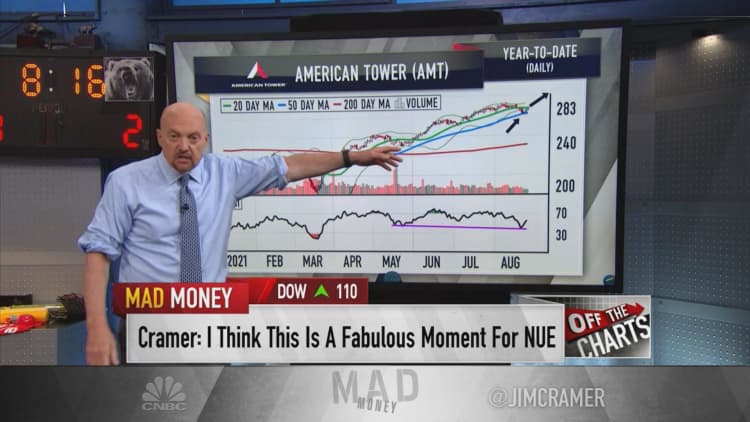

American Tower

American Tower, a real estate investment trust that provides wireless communications infrastructure, is well-positioned to benefit from the broadband internet investments that are included in the bipartisan proposal, Cramer said.

Lang thinks the volume trends in American Tower look strong, Cramer said, and it doesn't appear overbought per the Relative Strength Index.

"At $283, this stock is six bucks away from making a new high. If it can get a little momentum going, Lang thinks it can run to $330 in the relatively near future and then to $350," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com